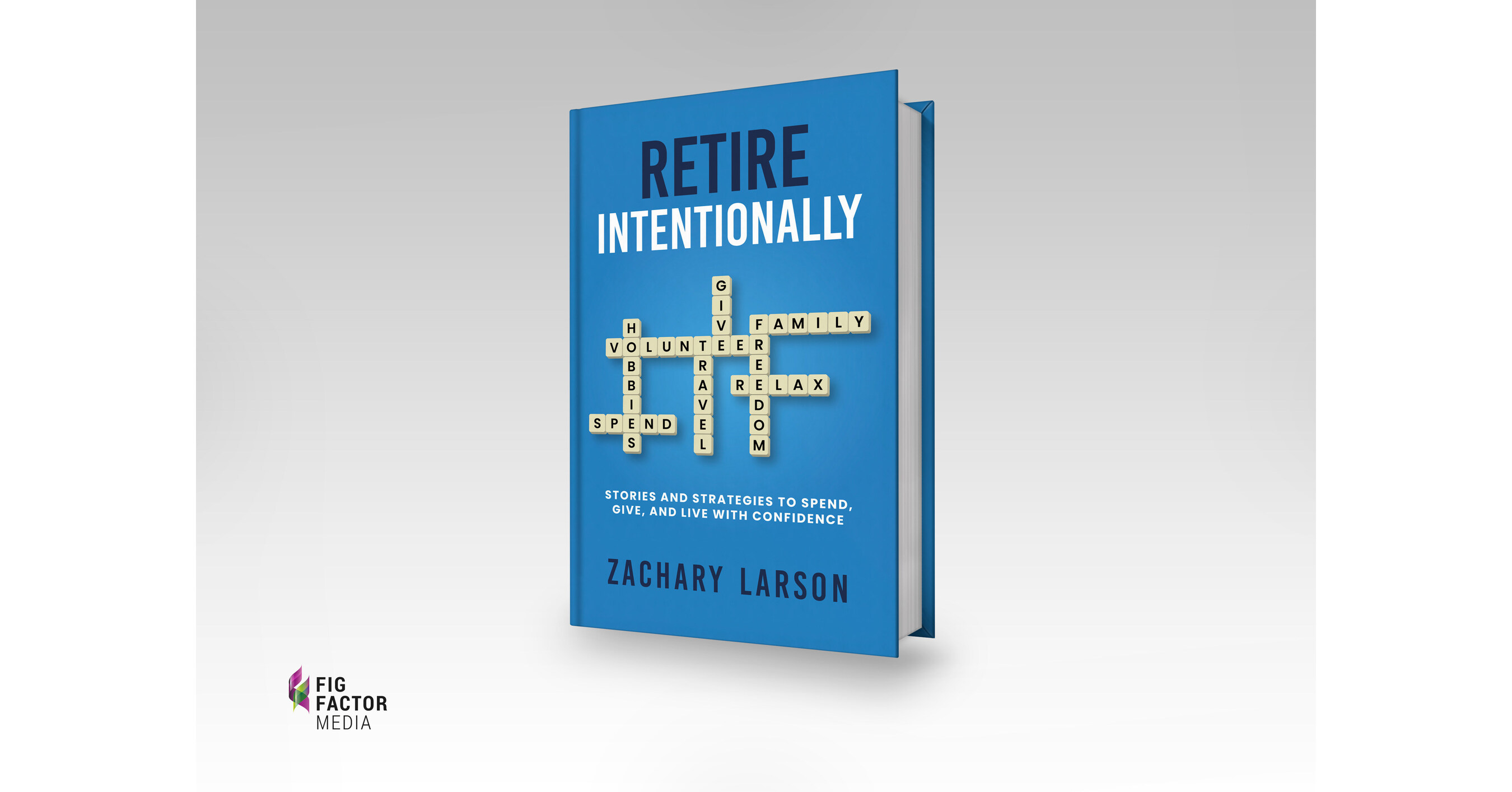

“This idea—intentional living—moves away from traditional recommendations, integrating the dreams and goals of the almost-and new retiree as it examines the trajectory and likelihood of their current plans,” Larson wrote. “My biggest and best realization is that, if done well (or intentionally) then retirement is less about an ending and more about a beginning. Retirement can be the beginning of a period where personal time, family time, travel time and volunteer time take center stage.”

To assist readers in comprehending all that surrounds retirement, the book actively asks readers what they want to do with their money. Additionally, Larson intersperses the book with stories from people who decided to live with intention and not by accident. Readers will also learn financial concepts such as asset allocation, income creation, taxes, and fees in understandable terms. After reading each chapter, readers will find a resource or a worksheet to get them into action mode.

“My personal calling, and our company’s mission, is to empower people to live intentionally,” Larson explained in his book. “That means I’m not telling you how to do things—You get to choose how to use the ideas and apply them to your life as you see fit. I will coach and encourage you to use your money intentionally, not accidentally!”

About “Retire Intentionally”:

Retiring intentionally and meaningfully is possible. No longer do you need to stand idly by, confused, and intimidated by the various plans you have put into place for your later years. No longer do you need to wonder about the best routes to take to maximize your investments and assets? When you learn how to make the most of your money to make the most of your life, giving to others as you give to yourself, that is retiring intentionally.

Born from years of client conversations and a commitment to understanding and developing personal retirement plans that serve living on purpose, Zac’s strategies eschew traditional recommendations and derive from his professional advisory services that help people work through a lifetime of accumulating money to a lifetime of distributing it confidently and without fear.

“Retire Intentionally” features stories of real people making thoughtful, generous, and deliberate financial decisions and examines the trajectory and likelihood of the almost- and new retiree to determine where they may need to be realigned in the following sectors:

- Retirement Income Planning

- Investment Management

- Wealth Transfer

- Tax-efficiency Applications

- Charitable Planning

- And more …

Knowing the right recommendations to implement isn’t enough to live with security in this next phase of your life. Discover the three keys to spending your retirement years with purpose: Net Worth, Net Income, and Net Impact, which, when combined with IntentGen Financial Partners’ strategies, enable you to enrich your sunset years with increased abilities to spend, give, and live with confidence.

For more information, visit http://www.IntentGen.com and http://www.retire-intentionally.com.

Media Contact

Marie Lazzara, JJR Marketing, 630-400-3361, [email protected], https://jjrmarketing.com/

SOURCE Zac Larson

![Elon Musk calls for ‘deleting’ the Consumer Financial Protection Bureau [Video] Elon Musk calls for ‘deleting’ the Consumer Financial Protection Bureau [Video]](https://s.yimg.com/ny/api/res/1.2/2NROhrcYbdh_aJTy6uhXMQ--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/aol_yahoo_finance_433/530d75ea5497f7e20ce377080b3e9264)