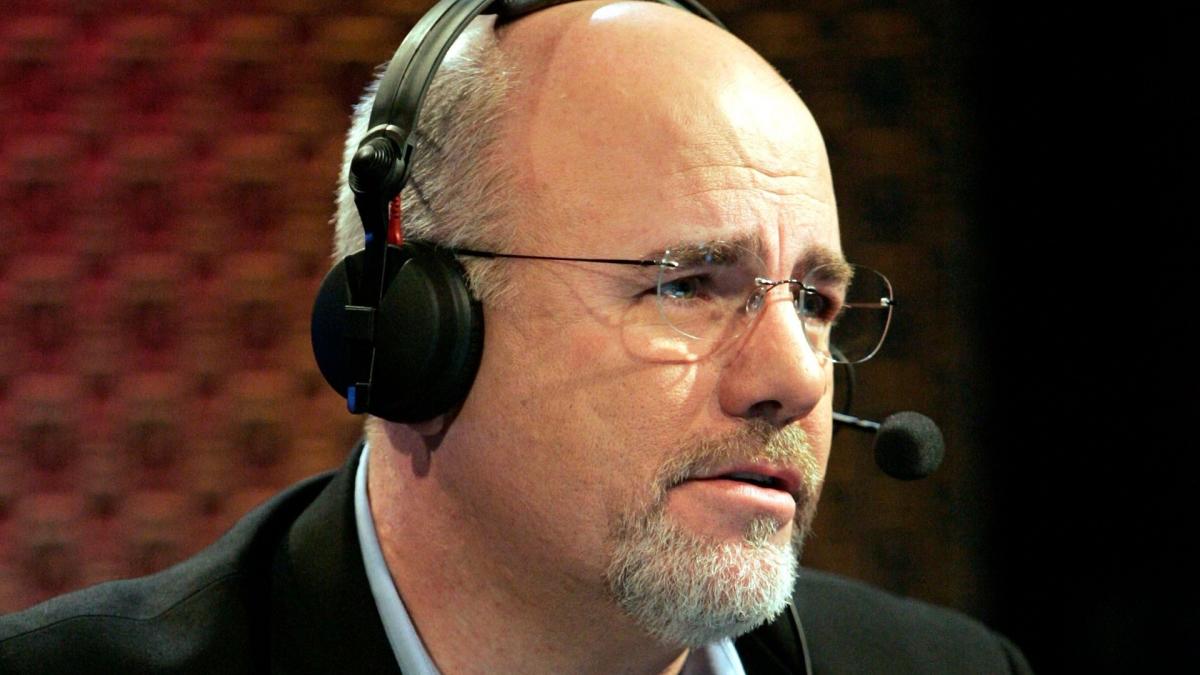

Dave Ramsey, the well-known personal finance expert, says he needs only a few investments to protect his money from inflation — and one he recommends is real estate.

Check Out: 5 Ways To Pick Your Next Investment, According to Experts

Explore More: 9 Easy Ways To Grow Your Wealth in 2024

Here’s what Ramsey says about how he invests in real estate and his opinion on mortgages for investment properties.

Investments and Inflation

If you have savings sitting in a bank account, that money is worth a little bit less every year due to inflation. This is one of the reasons many people invest their money in things like stocks or bonds — if your investments are growing in value at a faster rate than inflation, then you avoid slowly losing your savings.

Many financial advisors recommend putting your money into a diversified portfolio. What this means is that you minimize risk by not keeping all your money in the same place. You put it in a wide range of different investments, such as stocks, bonds, commodities and real estate. The theory is that a wider range of investments makes you less likely to lose everything at the same time.

Ramsey’s approach is a bit different. He says he needs just three investments: his business, an S&P 500 index fund and debt-free real estate.

The S&P 500 is a collection of 500 of the largest companies listed on the U.S. stock exchange and is often used as a way of measuring how well the market is doing overall, so it’s usually recommended as a way for regular people to invest in stocks. If you invest in the market overall, there is less risk than picking just a few companies that may do well or fail.

Find Out: I’m a Financial Advisor — 6 Steps To Take If You Have $1,000 To Invest

Debt-Free Real Estate Investing

Ramsey’s advice for investing in real estate is to do it debt free, which is different from what many other financial influencers recommend.

Ramsey is known for being conservative when it comes to debt. He began his real estate career at 18 and became a millionaire by 26. He then faced bankruptcy, which he says was due to heavy borrowing. Ramsey now promotes avoiding mortgages where possible, especially when it comes to investment properties.

Ramsey says buying real estate with cash reduces financial risk. Without debt, investors can fully benefit from property appreciation without the burden of interest payments. They also don’t have to worry about losing the property if they aren’t able to maintain their current income or find someone to rent it to.

However, purchasing property without a loan requires substantial upfront capital. This may not be practical for everyone. Ramsey points out that alternatives such as real estate investment trusts (REITs) allow people to invest in real estate with smaller amounts of money.

Some financial influencers may argue that using mortgages can amplify investment returns. Low-interest loans can free up capital for other opportunities. But this does come with increased risk, especially if property values drop or rental income decreases.

Before making investment decisions, it’s important to assess your own financial circumstances. It can be a good idea to consult with a financial professional who can provide you with personalized guidance.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey’s Bold Strategy for Battling Inflation