MK6006 Marketing Consultancy Project Marking Scheme

MK6006 Marketing Consultancy Project

Student Number: U1818702

| Comments | Max Mark | Actual Mark | |

| Phase One: Goal Setting

This should include an overview of the corporate mission and objectives |

15% | ||

| Phase Two: Situation Review

This should include a marketing audit (including PESTLE analysis), an overview of the market (including primary and secondary research) and SWOT analysis of the company |

20% | ||

| Phase Three: Strategy Formulation

This should include the assumptions of the marketing plan, the marketing objectives and 7Ps strategy and the projected results |

40% | ||

| Phase Four: Resource Allocation and Monitoring

This should include the budget, sales forecasts, implementation and monitoring plan for the campaign |

15% | ||

| Organisation, Presentation and References

Well-structured and ordered marketing plan with correct use of grammar and syntax. In-text citation and bibliography conforming to “Cite Them Right”

|

10% | ||

| Total | 100% | ||

| General Comments: | Agreed Mark: | ||

Dissertation Deposit Agreement

Library and Learning Services at UEL can host dissertations identified by academic staff as being of high quality. These dissertations will be included on UEL Research Repository, the institutional repository, as examples for other students following the same courses in the future, and as a showcase of the best student work produced at UEL.

This Agreement details the permission we seek from you as the author to make your dissertation available. It allows UEL to add it to UEL Research Repository and make it available to others.

I DECLARE AS FOLLOWS:

- That I am the author and owner of the copyright in the Work and grant the University of East London a licence to make available the Work in digitised format through the Institutional Repository for the purposes of non-commercial research, private study, criticism, review and news reporting, illustration for teaching, and/or other educational purposes in electronic or print form

- That if my dissertation does include any substantial subsidiary material owned by third-party copyright holders, I have sought and obtained permission to include it in any version of my Work available in digital format via a stand-alone device or a communications network and that this permission encompasses the rights that I have granted to the University of East London.

- That I grant a non-exclusive licence to the University of East London and the user of the Work through this agreement. I retain all rights in the Work including my moral right to be identified as the author.

- That I agree for a relevant academic to nominate my Work for adding to UEL Research Repository if it meets their criteria for inclusion, but understand that only a few dissertations are selected.

- That if the repository administrators encounter problems with any digital file I supply, the administrators may change the format of the file. I also agree that the Institutional Repository administrators may, without changing content, migrate the Work to any medium or format for the purpose of future preservation and accessibility.

- That I have exercised reasonable care to ensure that the Work is original, and does not to the best of my knowledge break any UK law, infringe any third party’s copyright or other Intellectual Property Right, or contain any confidential material.

•That I understand that the University of East London does not have any obligation to take legal action on behalf of myself, or other rights holders, in the event of infringement of intellectual property rights, breach of contract or of any other right, in the Work.

I FURTHER DECLARE:

- That I can choose to declare my Work “Open Access”, available to anyoneworldwide using UEL Research Repository without barriers and that files will also be available to automated agents, and may be searched and copied by text mining and plagiarism detection software.

- That if I do not choose the Open Access option, the Work will only be available for use by accredited UEL staff and students for a limited period of time.

Dissertation Details

| Field name | Details to complete |

| Title of thesis | Marketing Consultancy Project: Samsung Marketing Plan |

| Supervisor(s)/advisor

Separate the surname (family name) from the forenames, given names or initials with a comma, e.g. Smith, Andrew J. |

Aidan Kelly |

| Author Affiliation

Name of school where you were based |

University of East London

Royal Docks School of Business |

| Qualification name

E.g. B.A., B.Sc, MA, MSc, MRes, PGDip |

Bsc |

| Course Title | Marketing |

| Date of Dissertation

Date submitted in format: YYYY-MM |

2021-05 |

| Does your dissertation contain primary research data?

If the answer to this question is yes, make sure to include your Research Ethics application as an appendices to your dissertation |

Yes No no |

| Do you want to make the

dissertation Open Access (on the public web) or Closed Access (for UEL users only)? |

Open Closed

open

|

By returning this form electronically from a recognised UEL email address

or UEL network system, I grant UEL the deposit agreement detailed above. I understand inclusion on and removal from UEL Research Repository is at UEL’s discretion.

Student Number: U1818702 Date: 20/06/2021

Marketing plan

MK6006 U1818702

Zoe Isabella STANEK

Executive Summary:

Samsung is one of the world’s leading producers of electronic devices. Currently, Samsung aims to build ‘connective tissue’ between product launches to use innovation to communicate the brand DNA of ‘relentless pioneer’ to Gen Z. The goal setting section summarises the current corporate objectives. These goals include:

- Increase Samsung’s market share amongst Gen Z from 3% to 5% in the following five years.

- Sell 10% more devices in the next three years by providing an affordable smart phone option to encourage Gen Z sales.

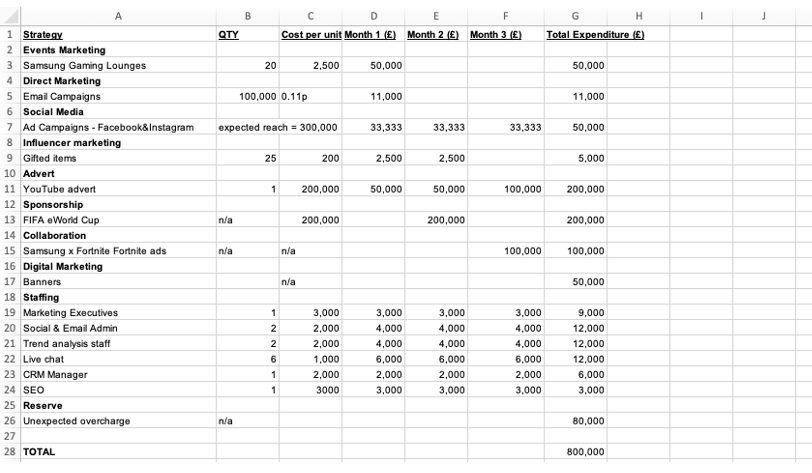

The situation analysis outlines the internal and external research conducted on the UK technology market with crucial takeaways of Gen Z consumer behaviour. Before identifying strategies, key assumptions have been made to disclose of any uncertainty and risk and allow for effective planning. Objectives, strategies and tactics have been advantageously set, covering the marketing mix to assist reaching the overall corporate goals. Tactics and strategies chosen synergistically work together to create a successful integrated marketing communications plan. With evidence of high amounts of device usage for gaming, an overall gaming positing will be taken for the marketing plan. Studies pinpointing popular game, ‘Fortnite’ to be building strong bonds between Gen Z consumers brings opportunity for capitalisation on this trend. To measure the success of the marketing plan, a variety of metrics and monitoring methods have been applied to each strategy. An £800,000 budget has been set over a quarter with a 10% reserve for unexpected overspend.

Table of Contents

MK6006 Marketing Consultancy Project Marking Scheme.

1.0 Phase 1: Goal Setting.

2.0 Phase Two: Situation Analysis.

2.1 The overall market.

2.2 The Market Size and growth.

2.3 The Gen Z Market.

2.4 Competition.

2.5 Competitive Profile Matrix.

2.6 PESTLE analysis.

2.7 SWOT analysis.

3.0 Phase Three: Strategy Formation.

3.1 Assumptions.

3.2 Strategies.

3.3 Product

3.4 Price.

3.5 Place.

3.6 Promotion.

3.6.1 Marketing events.

3.6.2 Direct Marketing.

3.6.3 Influencer marketing.

3.6.4 YouTube advert

3.6.5 Online Community.

3.6.6 Sponsorship.

3.6.7 Digital In-Game Advertisements.

3.6.8 Personal selling.

3.7 People.

3.8 Process.

3.9 Physical evidence.

4.0 Stage 4: Monitoring & Budget.

- 1 Monitoring.

4.2 Product.

4.3 Price.

4.4 Place.

4.5 Promotion tactics.

4.6 People.

4.7 Process.

4.8 Physical Evidence.

4.6 Budget.

5.0 Conclusion.

6.0 Appendices.

6.1 Appendix A – Competitive Profile Matrix.

6.2 Appendix B – SWOT Analysis.

6.3 Appendix C – Marketing budget spent over quarter.

7.0 References.

1.0 Phase 1: Goal Setting

Samsung is one of the world’s leading producers of electronic devices. Founded in Korea, Samsung topped annual lists of the best-selling smartphones in the world (Bondarenko, 2020). Whilst the brand provides a wide range of consumer electronics, Samsung is perhaps most recognised in the current day for their communication devices.

Samsung’s continued success within the smartphone industry proves their product; Samsung sold 62.12 million smart communication devices to consumers globally (O’Dea, 2021). However, competitor Apple continues to gain market share amongst generation Z consumers. A figure of 32% of Gen Z smartphone users opt for Samsung, compared to 21% of alternative devices (Moshfegh, 2020). Samsung hopes to now aim their marketing efforts towards Gen Z customers to gain a higher usage percentage.

Over recent years, creativity and innovation has been the driving factor for growth, specifically in technology-based industries. Innovation, meaning a new idea or method of doing something, is demanded by consumers who are consistently seeking the next best thing. It is essential that Samsung communicate and use innovative management processes to attain various benefits in the global market (Dawson & Andriopoulos, 2014). Currently, Samsung holds a focus on people inspired innovation. This has led to the creation of the likes of foldable phones and performance technologies (Samsung NewsRoom, 2019). The following marketing plan extends the innovation created by Samsung by highlighting their ‘relentless pioneer’ brand DNA.

The following mission statement is given for an overall summary for the UK Generation Z (Gen Z) market:

“We will devote our human resources and technology to create superior products and services, thereby contributing to a better global society.”

The mission statement made by Samsung highlights the superiority of products made by the company. ‘Devote’ suggests the endless effort put into designing and making each product from Samsung. Further, ‘devote our human resources and technologies’ is a declaration of the objective to increase the synergy effect of the management system through human resources and technologies. The use of the word ‘superior’ (meaning higher in rank, status or quality) segments the company into a higher quality market, above its competitors. Creating ‘superior’ products uses the ‘better mousetraps strategy’, identifying Samsung’s products as ‘better’, hoping that customers will buy into this ideology. Samsung must innovate in order to win consumers. Holt (2020) presented the limitations of relying purely on innovation to build ‘a better mousetrap’. Holt (2020) elaborates to explain the necessity for a combination of cultural story telling paired with product innovation to dominate the market. To successfully adopt this strategy, Samsung must build culture elements into their integrated marketing communications and branding. Further, this section of the mission statement contributes to the company objective of providing the upmost customer satisfaction additionally to retaining 1st position in the world (Samsung, 2021). Through the use of the phrase ‘contributing to a better global society’, Samsung illustrates the confidence they possess in not only benefiting the consumer, but communities as a whole. Through this, it is implied that Samsung take ownership in being a responsible company. It is thus suggested that Samsung make a global difference through purchases by consumers. Consequently, this addresses the company objective of contributing to common interests and a richer life.

1.1 Brand DNA

Samsung requests to continue the brand DNA of ‘relentless pioneer’. ‘Pioneer’ connotes the idea of the first to explore a new area or idea. From this, it is essential to understand that Samsung must appear in the mind of the consumer as the first to expand new technology. As Holt (2004) suggests, companies often fail when marketing new technology as they do not make historic and cultural connections. Therefore, to successfully market new technology, Samsung must bring in cultural elements to attain iconic status. Further, ‘relentless’ elicits unceasingly intense imagery (Cambridge Dictionary, 2020). As a result, a persistent new technology provider is created. The wording of the brand DNA will be the driving factor behind all objectives and marketing tactics.

1.2 Corporate Objectives:

- Increase Samsung’s market share amongst Gen Z from 3% to 5% in the following five years.

- Sell 10% more devices in the next three years by providing an affordable smart phone option to encourage Gen Z sales.

Commercial goals with supporting financial objectives shape the marketing plan. Full use of the marketing mix has been applied to the set objectives to ensure synergy and overall success amongst Gen Z in the UK market. A period of three years has been set as per recommendation of McDonald & Wilson (1984) to the objectives to allow a clear view of marketing plan implementation success.

2.0 Phase Two: Situation Analysis

The overall market

The overarching industry bracket of electronics includes telecommunication, electronic components, industrial electronics and consumer electronics. Whilst Samsung operates across these sectors (Samsung, 2021), the marketing plan will place a focus on consumer electronics. Consumer electronics includes the likes of smart phones and the newer addition of wearable technology such as smart watches (Stanley, 2019). The aim of such devices is to simplify but also provide added value to the life of the customer. In the UK, communication sales are most widely conducted through brand websites and telecommunications services such as T-Mobile and Three (Beers, 2021). The recent roll out of 5G has allowed the industry to partly develop however there is much needed innovation for exponential and continuous growth of the industry (Mintel, 2020).

The Market Size and growth

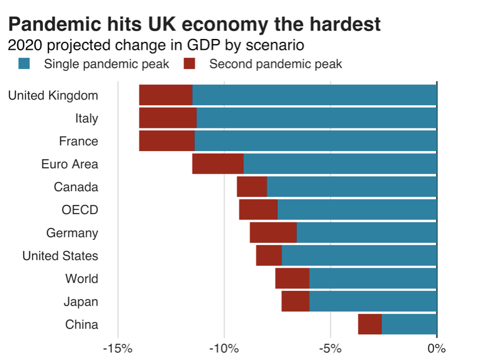

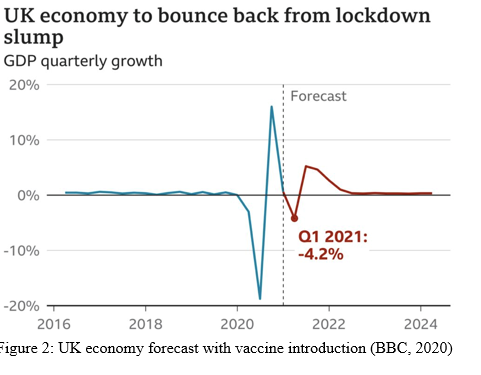

Consumers within the UK are heavy phone users. Despite suffering negative impacts due to the Covid-19 pandemic, the UK mobile phone market is currently valued at 6,519 million (IbisWorld, 2020). The industry has experienced a drastic drop in sales over the year 2020 and predictions reveal that the market will not recover until 2024 (BBC, 2020). The graph seen in figure 1 highlights the detrimental pandemic effect on the UK economy, compared to alternative countries. Nevertheless, 90% of Gen Z own a smart phone and 80% of general UK consumers also possess one (Mintel, 2020). From the data displayed, it is evident that a focus on UK Gen Z consumers boasts an attractive proposal.

However, with circulating uncertainty, it is undetermined whether consumers will hold off on upgrading and instead downgrade or purchase a similar phone to their existing device. It is important to note that these assumptions will only be valid if the UK continues to move progressively out of lockdown tiers. The recession which will undoubtably follow will also create a decrease in household disposable income, in turn affecting general expenditure.

Social media has played a large role in communication throughout 2020 and there are currently 3.96 billion users worldwide (Dean, 2021). However, there are also negative impacts which come hand in hand with social media such as fake news, online crime and cyberbullying (Overton, 2019). According to Mintel (2020), 80% of social media users believe the platforms can have a negative impact on mental health, breeding problems such as anxiety and self-esteem issues. This has led to 49% of users cutting down on social media usage (Mintel, 2020). In support of this, the most common reasons for deleting social media in 2019 can be seen in figure 3. For example, the top two reasons for consumers deleting social media in figure 3 are ‘overload’ and ‘addiction’. Therefore, Samsung must develop a method of putting users in control of their exposure to social media.

Other developing trends within the market include data monitoring wearable technology. Wearable technology was an increasingly sought-after product before the pandemic. With Covid-19 feeding consumer’s health concerns,combined with new ways to communicate, as per identified as a consumer concern during Covid-19.

An extremely important and consistently developing trend which will be carried into the future is the human reliance on technology. Consumers are constantly on the search for technology which will simplify their lives and allow them to communicate immersively. As people were stripped of traditional communication methods during the Covid-19 pandemic, technology has developed to find new ways of connecting. With the demand building for further personal contact through virtual devices, electrical companies have focused upon transforming virtual connections into more realistic experiences (Diebner et al., 2020). As consumers continue to actively search for new methods of communication, it is essential that Samsung tap into the ways in which Gen Z currently communicate. Slefo (2019) conducted a study which outlined Fortnite to have more in common with social media site Facebook than indirect competitor game ‘Call of Duty’ for Gen Z. Further, Campbell (2016) describes the way in which popular game ‘Fortnite’ is strengthening friendships. With no other organisations as of yet collaborating with Fortnite, this poses the opportunity to capitalise on this new method of communicating. This will form an essential part of the marketing plan.

2.3 The Gen Z Market

For complete understanding of the marketing plan, it is essential to understand Generation Z’s consumer behaviour within the electronics market.

The bracket ‘Gen Z’ includes ages 6 to 24. The interesting and unique point about Gen Z consumers are that they are the first to grow up surrounded by developed technology. Previous generations have slowly been introduced to a range of technologies in latter life. Interestingly, whilst 96% of Gen Z own a smartphone, only one third prioritise having the latest models (Mintel, 2020). As a result, this suggests that Gen Z are interested in products with value for money over the latest technology. Other important features include apps and ease of use (Mintel, 2020). In an effort to address these wants, software updates to older devices and wearable technologies have been capitalised by companies such as Samsung.

Below is some relevant data collected by Mintel (2020) to understand Gen Z consumers:

- Gen Z make up 32% of the world’s population

- Gen Z spend longer consuming content across devices compared to millennials

- 81% of Gen Z claim they play games on their devices

- Gen Z are price sensitive consumers – 67% of Gen Z have not purchased an upgrade because of price reasons, compared to 50% of general consumers

- 50% of Gen Z look for a phone with privacy in mind. In comparison, only 33% of general consumers use privacy as a key consideration point.

- Gen Z rely on parents for additional support in device decision making despite full understanding of the market.

- Gen Z have the highest usage time of all generations at 5.9 hours a day on their phones.

- Gen Z are most open minded towards new product development such as foldable smart phones.

- Gen Z are heavily influenced by peers’ choices of devices.

2.4 Competition

There are two dominant leaders within the communication device market, Samsung and Apple. Whilst Apple boasts higher brand loyalty figures, the consumer device ownership for both Apple and Samsung remained at 35% in 2019 (IDC, 2021). Therefore, competition between market leaders is fierce and success in identifying the critical success factors (CSFs) outline the organisational success.

2.5 Competitive Profile Matrix

A competitive profile matrix has been completed (as seen in appendix A) to gain an in-depth insight into where Samsung places in the industry compared to market competitors. The competitive profile matrix scored Apple a total of 108 points whilst Samsung scored 103. This highlighted the close competition between the two top scoring brands. Samsung’s current weaknesses compared to Apple lie in the critical success factors of ease of use, what is used amongst peers and marketing efforts.

The scoring of each critical success factor can be seen below:

| Company | Affordable Pricing score | New Product Development/ Quality score | Ease of Use score | What is used amongst peers score | Marketing Strategy score |

| Samsung | 7 | 6 | 7 | 7 | 7 |

| Apple | 8 | 9 | 8 | 7 | 6 |

| Xiaomi | 2 | 1 | 5 | 6 | 7 |

| Huawei | 5 | 3 | 6 | 6 | 8 |

The weighting was multiplied by the critical success factor scores to identify the following results:

| Company | Total score |

| Samsung | 103 |

| Apple | 108 |

| Xiaomi | 60 |

| Huawei | 86 |

2.6 PESTLE analysis

To gain a further understanding of the external market a PESTLE analysis will be used. The PESTLE acronym stands for political, economic, social, technological, legal and environmental factors from the external environment which may affect the company in either a positive or negative way.

Political:

The launch of Brexit has brought new trade restrictions, legislations and import laws. This will undoubtably have a large impact on Samsung. Because Samsung does not manufacture in the UK, the company is required to import goods which carries import fees which will increase post Brexit (BBC, 2020). The Great British Pound (GBP) value is also being depreciated due to Brexit (BBC, 2020). The GBP has begun to decrease in value which will therefore lead to an increase in prices at the cost of the customer (Thomas-Bryant, 2021).

Economic:

The UK economy has suffered and will continue to suffer from the implications of the ongoing Covid-19 pandemic. In addition to the country declaring a recession, the general public has seen a huge increase in unemployment rates. In October 2020, 1.69 million UK residents were marked as unemployed (King, 2021). Therefore, general consumers are facing a reduced disposable income which will directly impact Samsung’s sales. Additionally, the furlough scheme will have a large impact on the economy and is predicted to cause UK inflation. To offset such costs, businesses will be required to increase product prices. As a result, the more price sensitive consumer segments will be more reserved when spending disposable income, producing a direct impact on Samsung’s sales.

Social:

Social impacts of Covid-19 have included the change in education. As the UK was ordered to ‘stay at home’, school and higher education was moved online. Gen Z, who could have just started their career or still be in the education system, have become extremely dependent on technology for their daily life. This has and will continue to be a huge opportunity for technology companies such as Samsung. Further, the way in which humans interact has vastly changed during 2020 and 2021. Consumers are frequently relying on applications such as Zoom and Facetime to recreate conventional in-person communication. Consequently, an opportunity for new communication methods is created for Technology companies such as Samsung.

Technological:

Subscription services are an increasingly widespread business model (Emmer, 2019). With decreases in disposable income, consumers are actively searching for both financial security and flexibility. Samsung must adapt payment methods and technology to ensure security and flexibility are at the front of designs. Recent technology developments include 5G. As the roll out continues and 5G capabilities are expected, Samsung must ensure devices are 5G compatible and software must be updated to ensure smooth running and optimal performance. Further, the 5G roll out is a huge development in the gaming world, allowing for better augmented reality experiences. Subsequently, this poses a supported opportunity for a gaming positioning strategy for technology companies.

Legal:

General Data Protection Regulation (GDPR) laws have been revised recently due to Brexit. This will have an effect on all marketing capabilities and companies will have to alter the way in which they store and use consumer data. Failure to comply with GDPR laws will result in fines, backlash and negative effects on sales due to a change in consumer attitude. During 2019, Google faced backlash and a £44m fine due to the misuse of consumer data (Fox, 2019). Samsung must ensure they comply with laws to avoid a depreciation in sales from poor public relations representation.

Environmental:

Consumers have become more aware of the devastating effects that manufacturing has on the environment. This comes with data from Forbes (Barbiroglio, 2019) that 41% of 18- to 25-year-olds believe global warming is the most pressing issue facing the world. Samsung must cater to the environmentally conscious consumer by publicly reducing manufacturing impacts through techniques such as offsetting emissions.

2.7 SWOT analysis

A complete SWOT (strengths, weaknesses, opportunities and threats) analysis can be seen in appendix B. Below is a table of key information pointers:

| Strengths | Weaknesses | Opportunities | Threats |

| 34 product development centres.

Ranked number 9 on the EPA’s 2016 Green Power Partner list for Top 30 Tech and Telecom companies recognized for significant renewable energy investments (Samsung NewsRoom U.S., 2018) |

Does not own an operating system

Large product diversity. |

Covid-19 reliance on technology

Consumers seeking new ways to communicate through pandemic.

|

Between 2014 and 2015 Huawei’s share grew by 48.1%, and Xiaomi’s share grew by 29.4% (Mintel, 2020).

Brexit has caused a slowdown within supply chains. |

3.0 Phase Three: Strategy Formation

3.1 Assumptions

Because the Gen Z category spans from ages 6 to 24 years old, it is essential to make the assumption that children from 6 to 11 years old will not be purchasing a communication device nor have influence over a phone obtained on behalf of them. On the other hand, children from ages 12-18 years old will contribute to decision making on a phone purchased for them by a carer regardless to the fact they may not be purchasing themselves. The bracket of 19 to 23 years old will most likely be purchasing their own phone and therefore have high influence over the device purchased. Despite this, 19- to 23-year-olds will still seek final approval from parents over the phone brand (Mintel, 2020).

Therefore, Samsung can assume the following market segments:

6 to 11 years old – Minimal influence power and no purchasing power

12 to 18 years old – High influence power and low purchasing power

19 to 23 years old – High influence power and high purchasing power

3.2 Strategies

Marketing plan strapline: ‘The Connected Generation’

Overall positioning: Samsung will focus on communicating the brand DNA of ‘relentless pioneer’ through demonstrating ability to connect in innovative ways on Samsung devices. Samsung will enhance this by tapping into the ways in which Gen Z have recently been found to connect, which data highlights to be through gaming. Showcasing Samsung’s relentlessness, despite communications being restricted due to Covid-19, Samsung demonstrates their ability to adapt to allow consumers to connect, in their way. As a result, Samsung presents, ‘The Connected Generation’.

3.3 Product

- To sell 10% more smart phone accessories by the year 2023 by utilising added value for Gen Z through the creation of pop culture smart phone accessories available at each smart phone launch.

- Sell 10% more smart phones by the year 2023 by collaborating with high-profile online gamers to produce a gaming compatible device.

Data from Mintel (2020) shows 81% of Gen Z play games on their phone. This highlights the necessity for a gaming compatible phone. As a result, Samsung will work in collaboration with influencer gamers who have a large following on social media to produce a smart phone with desired gaming features. For example, gamer known by the name of ‘PewDiePie’ currently has 21.7 million Instagram followers and 109 million YouTube subscribers. Brands which operate at a popular cultural level attain ‘iconic’ status amongst consumers (Holt, 2004). As a result, through leveraging popular culture icon PewDiePie within the device creation, the model will attain ‘iconic’ status amongst Gen Z. The device (to be named the ‘Samsung Gamer Connect’) will boast key features suggested by the high-profile gamers. The influencer marketing used will be an essential promotional point of the device. Due to the recent and on-going 5G implementation across the UK and the incredible gaming capabilities this carries for on-the-go gamers, devices must be designed to enhance 5G usage. The 5G roll out will produce enriching gaming experiences and devices must have high quality imaging on screen to support gaming applications.

Campbell (2016) describes the way in which popular game ‘Fortnite’ is strengthening friendships between Gen Z players. Moreover, with knowledge that Covid-19 has impacted the way in which consumers can connect with each other, gaming has been portrayed to be building positive interactions between consumers. In a survey conducted on Fortnite gamers, 66% said their friendships had improved because of the game (Campbell, 2016). Slefo (2019) conducted a study which outlined Fortnite to have more in common with social media site, Facebook, than indirect competitor game, ‘Call of Duty’, for Gen Z. As a result, Samsung will be working with Fortnite to produce smart phone accessories such as phone cases. Gen Z will be able to choose from their favourite Fortnite character’s merchandise. Working with the popular culture trend of Fortnite to produce accessories will increase sales of smart phone accessories.

As per the assumption that parents are influential figures in decision making and purchasing processes, the new model will be made with in-built privacy features to satisfy parental desires to keep their Gen Z child safe. Further, 50% of Gen Z consumers agree with the statement, ‘privacy concerns have influenced my choice of smartphone brand’ (Mintel, 2020). Subsequently, the device will allow for parental locks which parents can set from their Samsung phone on to their child’s. The software will give weekly reports of the sites and apps which the child has been using. Additionally, parents have the ability to turn off information sharing with their chosen apps and websites to protect user privacy. To target the 19–23 year old segment of the Gen Z market, all privacy able to be adjusted as desired through settings. From customisable safety features, the 50% of Generation Z consumers wanting personalised products and experiences are also addressed (Talbot, 2020).

With 22% of consumers concerned with the amount of time spent online (Mintel, 2020), products and software must be designed to empower consumers with usage information so individuals can make their own informed decisions. Therefore, Samsung will develop an innovative system which allows parents to access their child’s screen time. This will be an addition to the pre-existing ‘Samsung Family Hub’. From the Family Hub, parents will be able to restrict and reward their child’s screen time. For example, a one-hour limit for gaming can be put in place with the option to ‘reward’ more time. For the segment of Gen Z who are less controlled by parents, screen time warnings will be in place for the time the individual chooses. For example, if an individual decides to limit social media to two hours per day, their phone will send them warning notifications when they have 30 minutes left. Once two hours is up, the phone owner will be required to unlock the screen time with a password to use beyond the given time.

3.4 Price

- To sell 10% more devices in the next 3 years by providing cost-plus pricing strategies to new smartphones.

With the assumption that 67% of Gen Z agree with the statement that the price of the latest smartphones has stopped them from upgrading from their current phone (Mintel, 2020), Samsung must price competitively. Further, a reduction in consumer disposable incomes will have an immediate effect on customer budgets for smart phones. As a result, Samsung will undercut main competitor, Apple. The iPhone SE is Apple’s cheapest phone model on the market at £400. The iPhone SE was launched in 2017 (Beavis, 2020) and therefore is outdated and not compatible with 5G. A cost-plus pricing strategy will be adopted for Samsung devices. The average phone costs £200 to manufacture (Do, 2021). Samsung will set a markup of 50%, resulting in a £300 phone, undercutting Apple’s cheapest yet oldest model.

3.5 Place

Due to uncertainty surrounding the Covid-19 pandemic, there will be a focus on online distribution. This will allow for effective purchases should the pandemic continue. With this in mind, consumers are less willing to travel considerable distances to make purchases. As a result, a store locater will be available online to support ease of access to in store purchases, comparatively to competitors.

Samsung should continue stocking in flagship stores and alternative retailers. Continuing with Samsung availability within retailers such as Curry’s PC World develops the accessibility of the brand.

3.6 Promotion

- Increase market share of Samsung for Gen Z from 3% to 7% in the next 5 years through communication activities.

- To promote a gaming phone to 15% of the Gen Z market by the end of three years

- Achieve a click through rate of 1% on online ad campaigns over a three-year period.

3.6.1 Marketing events

Expanding on the overall gaming positioning of Samsung’s Generation Z campaign, Samsung will communicate innovation and brand DNA of a relentless pioneer through exciting and new gaming experiences. Samsung will be collaborating with Fortnite to host ‘Samsung x Fortnite Gaming Lounges’ at festivals and in shopping centres across the UK. Samsung will create both virtual reality and augmented reality gaming experiences within the lounges, demonstrating the innovative capabilities of the gaming phone. The marketing events described additionally act as essential building blocks for strong customer relationships, creating competitive advantage and customer loyalty (Moise & Cruceru, 2013). When taking part in the Samsung x Fortnite Gaming Lounges, customers can enter the Gaming Lounge leader board. To be on the leader board, participants must provide Samsung with their email address, providing the opportunity for direct marketing email campaigns. The email activities support any marketing communications done by Samsung and thus contributes to customer centricity from the five stages of interaction maturity (Mcdonald and Wilson, 2016). The leader board winner after all events have been completed will be emailed and subsequently gifted the gaming phone model with a virtual reality (VR) set.

3.6.2 Direct Marketing

Direct email marketing will be used as a supporting activity of marketing events. As previously described, emails will be collected in Samsung Gaming Lounges to be in with a chance of winning the ‘Samsung Gamer Connect’ and a VR set. Email campaigns outlining phone and accessory new releases will be sent to these subscribed individuals with the aim to increase purchase intent. Further, direct marketing will be used through website advertisement banners. Additionally, social media advertisements will be enlisted, targeting specifically ages 18–23-year-olds (those with high influence and high purchasing power).

3.6.3 Influencer marketing

Influencer marketing will be used amongst high profile gamers. Samsung will gift gaming live-streamers the Samsung gaming phone with virtual reality capabilities. Influencers will be asked to use the gifted items on livestreams, increasing product and brand awareness. McGinnies and Ward (1980) described the way in which trustworthiness of sources had a higher impact on purchase intent than expertise. As a result, highly trusted influencers amongst Gen Z audiences will be chosen. Data from Morning Consult (2019) shows 97% of Gen Z use YouTube, identifying YouTubers to possibly reflect high levels of trust from the generation.

3.6.4 YouTube advert

Capitalising on the extremely high percentage of YouTube usage amongst Gen Z, an advert focusing on being connected through Covid-19 through innovative gaming with Samsung will be aired on YouTube adverts. The advert will feature one male and one female, both appearing around the age of 18-24. The screen will be split and show the female in her home and male in his home. The two will be seen on their Samsung gaming phone playing Fortnite, laughing and working as a team. The screen will zoom to either parties’ alarm clock besides their bed and the clock hands will speed up, immitating time passing. The screen will cut to the pair waking up and immediately grabbing their phone to begin playing again. This time, the screen will divide again adding another two people of similar age, showing the four playing together. The additional two are seen with a VR (virtual reality) headset, playing in a different way but still as a team. One of the new team members says ‘I’m inviting my friends to join’ and the screen splits again and sees more team members join, all interacting with each other and working together. The image zooms in to one of the team members phone where a breaking news notification appears, pausing the game, with the writing ‘groups of 6 can meet again as of Friday’. The screen cuts to the individual clipping on their character Fortnite phone case and putting their phone in their bag. The screen cuts to the group playing in real life and using each other’s VR sets, swapping phone cases and having fun. The screen cuts again to parents joining the children, playing retro games from the parent’s childhood such as Space Invaders and Pacman, with the children spurring their parents on. The classic gaming link builds upon iconic brand status amongst consumers, connecting to past pop-culture (Holt, 2004). The connection to retro gaming will resonate with older generations, gaining purchase approval from parents. This also strengthens the advert through nostalgic marketing elements; Brands which draw upon nostalgia experience enhanced consumer-brand relationships (Kessous et al., 2015). The advert will contain a call to action in form of a link to the Samsung gaming phone and Fortnite accessories. This is expected to increase website traffic and purchase intent. The use of a relatable story line will resonate with Gen Z and allow consumers to express themselves through purchases. Using an identity myth in combination with storytelling such as the example in the YouTube ad described, allows Samsung to build an iconic brand (Roll, 2020).

3.6.5 Online Community

Samsung will also be building an online gaming community where gamers all over the world using Samsung devices can connect. Kumar et al (2016) states “investing in developing a social media community with a dedicated fan base (e.g., a Facebook page) can significantly strengthen customer–firm relationships and can lead to a definitive impact on the firm’s revenues and profits”. With Slefo (2019) demonstrating the close similarity of Fortnite and Facebook for Gen Z, Samsung hopes to take this further and develop a connected gaming experience. Within this, targeted towards the 19–23-year-old bracket, there will be a retro gaming section of the community, building upon the iconic brand. Smaller gaming influencers, with close relationships with their followers will be able to create ‘parties’ where followers can join and play with them. In turn, this will benefit the influencer by strengthening and building their own platform. The activity will be beneficial for both parties (Samsung and influencer). Party members can later go back and chat with the group, offer and ask for advice. Online social communities greatly influence customer loyalty (Muniz & O’Guinn, 2001) and this will be further enhanced by the necessity to have a Samsung device to belong to the community. Moreover, Helme-Guizon and Magnoni (2019) stated that brand hosted social interactions lead to high brand loyalty.

3.6.6 Sponsorship

Sponsorship will be an effective tool to communicate the brand DNA of relentless pioneer to a mass market. It is essential that Samsung sponsors events which reflect the general positioning of its integrated marketing communications to Gen Z. Aaker (1991) suggested strong brand associations to be a key contributor to brand equity. Moreover, Sözer and Vardar (2009) stated “event sponsorship is one of the main strategic communication tools that can be used to communicate effectively with the target market and consequently leverage the brand equity of the sponsor brand”. As a result, to enhance brand equity, Samsung will sponsor ‘e sporting events’. Streamed worldwide, the FIFAe World Cup sees the best FIFA players worldwide come head-to-head. Sponsoring the event will allow Samsung to become more recognised in the gaming market. Because the event is streamed worldwide, if the pandemic does not allow for in-person events, the sponsorship will continue to go ahead.

3.6.7 Digital In-Game Advertisements

To advertise the Fortnite x Samsung accessories, Samsung will use paid adverts within the Fortnite game. With a focused target market, these are expected have high success rates and click through rates. Digital in game adverts (DIGA) appear inside a 3D game environment, on virtual objects such as billboards, posters, and bus stops. Samsung plans to have digital in game adverts around the Fortnite map, similar to those seen in figure 4 and 5. Further, in the Fortnite game, characters are customisable. Samsung will work with Fortnite to allow players to customise their character to be holding the Samsung gaming phone, with their chosen phone case accessory, simulating the real-life devices. When inactive, characters with the Samsung phone will pick up their phone and begin texting, taking selfies and phone calls. The high success rate of digital in game advertising can be described to be due to the significant time spent by consumers on the channel (Hobbs, 2020). In support of this, due to coronavirus-related lockdowns, the average time consumers spent playing online each week increased from eight hours to ten and a half hours (Chandler, 2020). Marvin (2018) presented results from a survey showing 32.5% of players spend 6-10 hours on Fortnite and 17.3% spend 11-15 hours. Repeated and consistent exposure is expected to increase purchase intent. Similar to product placement in films, digital in game advertising allows players to interact with the advert in question and provides talking points with other players. Chang, Yan, Zhang & Luo (2010) demonstrated the effect of incongruent advertising to lead to high brand awareness. Through dynamic in game advertising, Samsung will gain significant market share amongst Gen Z Fortnite players.

.

3.6.8 Personal selling

With a reduction in retail store accessibility due to the pandemic, online sales can face reduction in conversion rates due to the lack of personal selling (Gui, 2018). As a result, Samsung must adopt online personal selling techniques. An online live chat should be used for customers to replicate traditional personal selling methods. Using this to develop a customer relationship management (CRM) tool can aid to differentiate between Samsung and competitors such as Apple. In turn, Samsung will gain customer interests, questions and information which can be utilised in line with GDPR regulations that also can be used to target customers in future campaigns. According to Mihaela (2016) “By creating, developing and retaining satisfactory customer relations, companies worldwide can create a significant competitive advantage, positively influencing their global performance.” The live chat will act as an intermediary between the information gathering and purchase decision stages of the customer decision making process and give Samsung competitive advantage. Despite a reduced cost, a mobile device is a high-involvement product (especially for the younger consumer market) therefore personal selling will increase purchases (Tanner & Raymond, 2013). The personal selling office will be UK based and a CRM manager will be employed to help assist in this.

3.7 People

For in store purchases, highly knowledgeable staff should be hired to mimic competitor Apple’s, Apple Geniuses. Customers will be able to utilise the staff by coming to them with any queries or technology problems, filling customers with confidence that their product is handled with the upmost professionality at every level within Samsung. In turn, this people strategy acts as physical evidence as to why products are ‘innovative’, as Samsung claims.

3.8 Process

The process will be improved with the addition of the promotional tactic of an online personal selling messaging service. Further, on the website will be a price and spec comparison chart to competitors such as Apple, to highlight Samsung to be the best option. This will add a Samsung controlled information gathering medium to the product acquisition process for consumers. Providing this information to customers will result in less consumers requiring to leave the site to seek alternatives, improving sales.

3.9 Physical evidence

Within the store, there will be an importance placed on store design. To communicate ‘relentless pioneer’ and innovation Samsung should incorporate new technology into the shopping experience. For example, upon walking in customers can interact with a robot which asks ‘what are you here for today?’. Depending on the answer, the robot will use artificial intelligence to give an appropriate answer and alert a member of staff it the customer requires. The store layout should be spacious and bright. Bright stores communicate honesty, in turn affecting sales (Birch, 2019). At the front of the store, for footfall to see through the shop window, will be a ‘play’ area, where customers are encouraged to play games on the devices against each other, with a daily scoreboard visible through the shop window. The experiential shopping experience will encourage higher amounts of customers in store. The overall store design will have a positive effect on sales.

4.0 Stage 4: Monitoring & Budget

4. 1 Monitoring

4.2 Product

To measure the effectiveness of the products, sales percentages will be used. Sales percentages will be measured from the launch of the accessories and gaming phone. These figures will also be comparable to previous launches. This will identify the level of success the products have compared to previous Samsung phones. This will be measured monthly and will contribute to an end of year report. Spotting any trends in fluctuation of sales percentages will additionally allow Samsung to identify the supporting promotional activities that may have influenced these sales. The hired trend analysts will collect and present these figures. Other important figures in measuring effectiveness of the product are repeat purchases (particularly for the phone cases which will more likely have repeat purchases as opposed to a high involvement product such as a phone). Customers purchasing online will be able to create an account for one day delivery. With knowledge that Gen Z believe fast delivery time is critical to purchases (Berthiaume, 2019), data from accounts will allow us to gain repeat purchase data. Further, growth in Samsung customers, specifically focusing on Gen Z will be measured by the Samsung marketing department. Growth in customers and repeat purchases will be measured annually. Further, customer satisfaction questionnaire emails will be sent three months after purchase. The statements will be responded to using a Likert scale with varying points from strongly disagree to strongly agree. Statements will include, “I am satisfied with my purchase” and “Since purchasing, I have looked for an alternative”. The data will be presented annually in graphs to understand the product success.

4.3 Price

To understand whether price has been successful, Samsung will conduct research on a captive audience. A survey will be completed at the Samsung Gaming Lounges, after the participant has played on the device. Answers will be using a sliding scale between £100 and £1000. Questions will include, “How much do you think the ‘Samsung Gamer Connect’ phone is priced at?” and “What would you be willing to pay for the ‘Samsung Gamer Connect’?”. Answers will be processed and allow us to gain insights into the accuracy of Samsung’s pricing. An average lower than the set price would indicate that the device is too expensive. An average higher than the set price would indicate success and the potential to price higher in future through penetration pricing.

4.4 Place

Website traffic will be monitored to understand the success of online distribution tactics. The store locator usage will also be measured in web page traffic. Consumers which arrive in store will be asked how they found the Samsung retailer, at point of purchase. Responses will be put through the Samsung till system for the trend analyst to present the collected data at the end of each year. This will allow for understanding of the level of store locator usage.

4.5 Promotion tactics

Promotion tactics will be measured using a variety of metrics. For social media ads click through rate will be focused on to allow us to understand the level to which we have met the objective of a 5% click through rate. Further, this will be used in combination with social media analytics such as reach, shares and likes to gain an overall understanding of the success. Website ad banners will be additionally measured as a click through rate. Both click through rates will be collected at the end of the campaign and presented by the hired trend analysists. To measure promotional tactics overall, market share of Samsung amongst a sample of Gen Z will be measured. This can be done by dividing Gen Z sales over the three-year period by the overall market sales. Further, this will be broken down, year by year, to identify growth throughout the marketing plan implementation. Samsung should expect to see a positive correlation and uphill trajectory between time since marketing plan implementation and market share. With a focus on online personal selling, success of personal selling will be measured through incoming live chat traffic and overall website traffic. Live chat traffic will also be measured in collaboration with the average time customers spent on the live chat. This will identify the customer value and use of the medium. Website traffic will be particularly important during launch times. Website traffic can be compared to previous launces to identify the level of excitement around the product launch. Finally, the online community success will be measured by download rate and active user percentage.

4.6 People

Success of people strategies will be measured through a survey button upon exit of the store. The question on the screen will read ‘How satisfied were you with the Samsung staff today?’. Customers will be presented with a traffic light system to which customers can select green, amber or red. This will give Samsung an idea of the success level of employees.

4.7 Process

As described in promotional strategies, live chat traffic will be measured alongside with time spent on the live chat.

4.8 Physical Evidence

To understand the impact of physical evidence strategies, in store traffic will be measured and evaluated prior and post store changes. The information will be processed by the trend analyst staff.

4.6 Budget

Appendix C outlines the cost of the marketing tools used in the marketing plan for Samsung to achieve their objectives with an £800,000 budget. Throughout the strategies, social media will be used as a supporting activity. Staff will also be required to run the social media ad campaigns, within a set budget. This will incur staffing costs. Marketing executives will oversee the communications activities whilst social media and email admins will guide social media platforms and distribute emails. A CRM manager will be employed to oversee live chat staff whilst social media and email admins will distribute content and direct email marketing. Search engine optimisation (SEO) will be enlisted to drive traffic to the website and will be essential in maximising sales and awareness of product launches. SEO will cost Samsung around £3,000 per month for a large-scale website and maximum return on investment. Trend analysts will be hired to successfully interpret data collected for monitoring of the implementation. Live chat assistants will be hired to run the live chat through working hours 9am to 5pm.

It is expected that through 20 Samsung Gaming Lounges will collect 5000 emails, Therefore, in total email admins will be required to distribute 100,000 emails. At an average of 11 pence per email, the emails will cost £11,000, 1.4% of the overall budget. With the average phone costing £200 to make, Samsung will gift 25 phones to influencers as part of the influencer marketing strategy. In total, this will incur a cost of £5,000. Digital marketing advertisement banners will be used to support the phone accessories additions. 6% of the budget will be placed upon this, including the creative designing process of banners. Social media will be mainly free to use and will provide essential brand awareness for Samsung. Outgoing costs of social media use are explicitly during advertisements. A budget of £50,000 will be used to support previously described activities through Instagram and Facebook ads, targeting Gen Z. It is extremely important to place a large portion of the budget on social media ads to increase exposure to Samsung for consumers, further strengthening other marketing tools. The largest portions of the budget will be spent on large scale sponsorship and the YouTube advert. The Sponsorship of the FIFA eWorld Cup is expected to cost around £200,000. £200,000 will also be spent on the YouTube advert, targeting specifically Gen Z YouTube accounts. Another large portion of the budget will be placed upon in game Fortnite in-game ads. Because of the in game focused target market, we expect these advertisements to have high click through rates, allowing for a large proportion of the budget placement. In the event of unexpected overcharges, 10% of the overall 800,000 budget has been set aside. This will allow for any extra or unplanned for activities or additional staff required.

5.0 Conclusion

The marketing plan has demonstrated immense potential of growth for Samsung amongst the Generation Z market. Samsung outlined the issues of Gen Z not consuming media in the way that previous consumers have and entering the world of gaming addresses this. Samsung requested a three-month plan with clear objectives and strategies to achieve them. If followed correctly, this will solidify a strong market position amongst the Generation Z population.

6.0 Appendices

6.1 Appendix A – Competitive Profile Matrix

AFFORDABLE PRICING = 5 (MOST IMPORTANT)

NEW PRODUCT DEVELOPMENT/QUALITY = 4

EASE OF USE = 3

WHAT IS USED AMONG PEERS (GEN Z) = 2

MARKETING EFFORTS = 1 (LEAST IMPORTANT)

SAMSUNG :

CSF5 – 7/10 – WEIGHTED SCORE – 35

CSF4 – 7/10 WEIGHTED SCORE – 28

CSF3 – 7/10 WEIGHTED SCORE – 21

CSF2 – 6/10 WEIGHTED SCORE – 12

CSF1 – 7/10 WEIGHTED SCORE – 7

TOTAL: 103

APPLE :

CSF5 – 6/10 WEIGHTED SCORE – 30

CSF4 –7/10 WEIGHTED SCORE – 28

CSF3 – 8/10 WEIGHTED SCORE – 24

CSF2- 9/10 WEIGHTED SCORE – 18

CSF1 – 8/10 WEIGHTED SCORE – 8

TOTAL: 108

XIAOMI :

CSF5 – 7/10 WEIGHTED SCORE – 35

CSF4 – 5/10 WEIGHTED SCORE – 20

CSF3– 4/10. WEIGHTED SCORE – 12

CSF2 – 1/10 WEIGHTED SCORE – 2

CSF1 – 2/10 WEIGHTED SCORE – 2

TOTAL: 60

HAWUEI :

CSF1 – 8/10 WEIGHTED SCORE – 40

CSF4 – 5/10 WEIGHTED SCORE – 2O

CSF3 – 5/10 WEIGHTED SCORE – 15

CSF2 – 3/10 WEIGHTED SCORE – 6

CSF1 – 5/10 WEIGHTED SCORE – 5

TOTAL: 86

| Company: | Affordable Pricing (CSF5) | New Product Development/Quality

(CSF 4) |

Ease of Use

(CSF 3) |

What is Used Amonst Peers

(CSF 2) |

Marketing Strategy

(CSF 1) |

SCORES: |

| Samsung | Samsung adopts multiple price strategies across its range of devices. Most commonly seen pricing strategies include skimming pricing and competitive pricing. Samsung’s new device to be launched starts at £769 however they also offer an ultra-version starting at £1329. Samsung creates phones suitable to all budgets. Samsung’s Galaxy A line, starting at £149.99 was received well amongst the general consumer market. | Samsung has a clear vision of large production volumes. Samsung produces products in many markets including TVs, LED lights, batteries, gaming devices, appliances, mobile phones, cameras, appliances and even medical devices. Samsung leads within many of the listed markets however within the communications devices industry Samsung consistently competes with Apple.

|

The Samsung S20 has been rated as the best quality phone on the market in 2021 by TechRadar. Mintel (2020) gave a satisfaction rating of 43%, ranking Samsung second in the world. Samsung’s business model efforts is focused in research and development, shortly followed by design. Unlike Apple, Samsung creates devices which are compatible with other brands, which is a critical success factor and important selling point which helps to retain customers. Customers do not get locked into Samsung devices after purchasing one.

|

Samsung’s general consumer awareness in the Gen Z market is 2% lower than Apple’s. This identifies the popularity of Samsung amongst Gen Z to be lower than Apple. Gen Z consumers also have misconceptions of cameras being lower in quality.

|

Samsung does have phones to suit varying budgets. Whilst Apple are successful with an extortionate price tag, phones are not what made Apple one of the largest companies in the world. Arguably, their accessories made the brand. Samsung imagery sees bold colours and designs such as butterflies, possibly symbolizing freedom and the addition to a beautiful life that Samsung creates. Consumers feel confidence by the showcasing of the leading brand statements. | CSF1 – 7/10

CSF2 – 7/10

CSF3 – 7/10

CSF4 – 6/10

CSF5 – 7/10 |

| Apple | Apple do not have the objective to produce a low-cost phone. Apple alternatively focus on high quality and cost products. Apple keep their costs high by only offering marginal wholesale discounts to wholesaler resulting in the wholesaler unable to produce discounts due to the minimal profit margin. The lowest cost Samsung phone is

the SE starting at £399. The SE came out in 2016, making in an outdated model.

|

Apple’s business strategy revolves around design and user experience. Apple outsource manufacturing to solely place their efforts on product development. Apple’s refined strategy focuses on one new line per year. Within the line comes modifications to suit the individual such as XR or XS versions. | Apple holds the highest rated consumer satisfaction (Mintel, 2020) within ease of use. Apple not only produces devices with ease of use as one of the main goals, but also implements ease of use into Apple’s culture such as aftercare services. Apple’s products uses programmes that work well with eachother but not any competitors, making it easy to continue to purchase into Apple and equally difficult to swap to a competitor. Apple further promotes ease of use through encouraging an ecosystem through iPhones, iPads, Apple TV, Apple Watches, Macs and more. | Apples holds the highest amount of both awareness and usage amongst UK Gen Z. 60% of Gen Z use an iPhone compared to the general market at 37% (Mintel, 2020). | Apple relies mostly on product placement and positive word of mouth and the buzz created in the media. Product placement is particularly used with celebrities and popular TV shows. Interestingly, Apple has written contracts which only allow product placement in the hands of the ‘good guys’ in films and TV shows (Sweney & Shoard, 2020). Overall, this gives Apple a non-tainted ‘perfect’ image in the media. Apple does not compromise on cheaper prices to avoid communicating a lower value product. Instead, Apple uses simple words and phrases in replacement of industry terms and jargon in copy to stress the necessity of Apple products to simplify the consumer life. | CSF1 – 6/10

CSF2 –7/10

CSF3 – 8/10

CSF4- 9/10

CSF5 – 8/10 |

| Xiaomi | Xiaomi produces extremely affordable smartphone options compared to competitors within the market. Prices start at £159 and increase to £619 for innovative models.

|

Xiaomi offer the best phone camera on the market and produce a wide variety of technology items. Xiaomi are particularly present in the software industry and most of Xiaomi’s worth lays in software, gaming and theme customisation. The high price to performance ratio products displayed by Xiaomi drive the rapidly increasing market share.

|

Xiaomi propose a large threat within the industry and particularly in wearable technologies and electronic scooters. With undercutting pricing strategies, Xiaomi is unlike other competitors. Xiamoi phones are rated highly and are developing extra storage space to increase ease of use. Being a new brand, there is limited data on ease of use compared to competitors.

|

The market share of Xiaomi amongst Gen Z is low despite owning the top rated camera phone (an extremely vital feature for many of Gen Z). Market share with Gen Z is currently at 1.78%. Xiaomi has been successful in similar behaving markets across the world and could evidently have the same effect in the UK.

|

Xiaomi ‘Just for Fans’ is a consumer lead campaign in which loyal fans of Xiaomi are part of product development. This has a great affect due to the involvement consumers feel in addition to allowing Xiaomi to have in depth customer insights. Flash sales allowed Xiaomi to build further hype amongst products and is a strategy neither Apple or Samsung have used.

|

CF1 – 7/10

CF2 – 6/10

Cf3 – 5/10.

CF4 – 1/10

CF5 – 2/10 |

| Huawei | Huawei aims to strike a balance between pricing lower than the majority of competitors without compromising appearance of quality. Lower models start at £89.99 but higher models are on the market for £750 to £1099.

|

Huawei has been slowly changing consumer perspectives to shift them towards being accepting of less recognized brands being equal to Samsung and Apple. During 2020, Huawei expanded their product range by adding ‘Seamless AI Life New Products’. The line included fitness data tracking and innovative noise cancellation audio technology. The aim of the line was to ‘simplify life’ (Huawei, 2020). | Mintel (2020) suggests a satisfaction rating of 39% for the Huawei brand. Huawei Mate 40 pro bagged the brand 80/100 for user friendliness. Comparing this to Apple’s iPhone 11, which only scored 67/100 (Smartphones Revealed, no date).

|

Huawei places third in the market, following Samsung due to the price point and high quality features such as the camera. | Huawei invests in digital and traditional marketing tactics and sells through an ecommerce platform. The website is designed to reflect marketing efforts, acting as its own promotional channel with the addition of google ads. Huawei is most recongised in its celebrity endorsement with famous personnel. For example, famous footballer, Lionel Messi, became Huawei’s global ambassador in 2016 (Huawei, 2016). Huawei frequently sponsors sporting events and partners with global brands to increase awareness. |

CF1- 8/10

CF2 – 6/10

CF3 – 6/10

CF4 – 3/10

CF5 – 5/10 |

6.2 Appendix B – SWOT Analysis

| Strengths | Weaknesses | Opportunities | Threats |

| Samsung boasts 34 research and development centers across the world (Samsung, 2021). Typically, there is a high correlation with investment in to research and development and success of a business due to the inevitable innovation. For example, Samsung’s answer to Apple Pay was able to be rolled out within a year due to research capabilities. | Can be said to have a too large product diversity which gives consumers a lack of confidence in Samsung.

|

Due to Covid-19, Samsung has the opportunity to capitalise on the human reliance on technology.

|

Chinese competitors such as Huawei are approaching Samsung’s market share. Between 2014 and 2015 Huawei’s share grew by 48.1%, and Xiaomi’s share grew by 29.4% (Mintel, 2020). As Chinese competitors become more renowned for quality products, Samsung faces fierce competition.

|

| Samsung has begun to cater to the environmentally conscious consumer and has actively reduced greenhouse emissions. Consequently, Samsung ranked number 9 on the EPA’s 2016 Green Power Partner list for Top 30 Tech and Telecom companies recognized for significant renewable energy investments (Samsung NewsRoom U.S., 2018) | Unlike iPhone, Samsung does not have its own operating system and runs from Android. This means they are not in control of their own operating system and cannot differentiate experiences from brands such as Huawei.

|

Covid-19 has further brought the opportunity within online education. Unique learning experiences are sought after to recreate traditional learning experiences.

|

Brexit and Covid-19 has vastly slowed down supply chains across the world. |

| Samsung outsources production to produce cost and quality focused products. Samsung’s unique selling point is specifically their high-quality products at affordable prices. Further, Samsung holds a strong and reliable brand reputation. | Take advantage of growing markets such as Africa and India.

|

The recession following the pandemic will cause a decrease in consumer disposable income. | |

| Samsung should develop a digital marketing focus. Although they are a globally recognised brand, they do not possess the same level of brand equity and popular culture as competitor Apple. Expanding online and social media marketing efforts could have a large impact and make Samsung more relevant to Gen Z. |

6.3 Appendix C – Marketing budget spent over quarter

7.0 References

Aaker, D, A. (1991) Managing Brand Equity: Capitalizing on the Value of a Brand Name. The Free Press: New York.

Aaker, D. (2012) The Genius Bar — Branding the Innovation. Available at: https://hbr.org/2012/01/the-genius-bar-branding-the-in (accessed 11/04/2021)

Apple NewsRoom (2016) Apple & Nike Launch the Perfect Running Partner, Apple Watch Nike+. Available at: https://www.apple.com/newsroom/2016/09/apple-nike-launch-apple-watch-nike/ (accessed 04/04/2021)

Barbiroglio, E. (2019) Generation Z Fears Climate Change More Than Anything Else. Available at: https://www.forbes.com/sites/emanuelabarbiroglio/2019/12/09/generation-z-fears-climate-change-more-than-anything-else/?sh=60c21ba6501b (accessed 04/04/2021)

BBC (2020) Coronavirus: UK economy ‘might not recover until 2024’. Available at: https://www.bbc.co.uk/news/business-53552494

Beavis, G (2020) iPhone SE (2020) review. Available at: https://www.techradar.com/uk/reviews/iphone-se (accessed: 11/04/2021)

Beers, B. (2021) What is the telecommunications sector? Available at: https://www.investopedia.com/ask/answers/070815/what-telecommunications-sector.asp (accessed: 01/05/2021)

Berthiaume, D. (2019) Survey: These consumers will pay for fast delivery. Available at: https://chainstoreage.com/technology/survey-these-consumers-will-pay-for-fast-delivery (accessed 11/04/2021)

Birch, J (2019) How does lighting affect sales in retail? Available at: https://www.colourgraphics.com/blog/how-does-lighting-affect-sales-in-retail/ (accessed: 04/05/2021)

Bondarenko, P. (2020) Samsung. Available at: https://www.britannica.com/topic/Samsung-Electronics (accessed 11/02/2021)

Cambridge Dictionary (2020) Relentless. Available at: https://dictionary.cambridge.org/dictionary/english/relentless (accessed 06/05/2021)

Campbell, S. (2016) The surprising way Fortnite strengthens Gen Z friendships — and what marketers can learn from it. Available at: https://www.reach3insights.com/blog/fortnite-strengthens-friendships (accessed 04/04/2021)

Chandler, S. (2020) Gamers Have Spent 10.4 Million Years Playing ‘Fortnite’. Available at: https://www.forbes.com/sites/simonchandler/2020/09/15/gamers-have-spent-104-million-years-playing-fortnite/?sh=2c47354b341f (accessed: 05/04/2021)

Chang, Y., & Yan, J., Zhang, J. & Luo, J. (2010) ‘Online In-Game Advertising Effect: Examining the Influence of a Match Between Games and Advertising’, Journal of Interactive Advertising, doi: 10.1080/15252019.2010.10722178

Dawson, P. M., & Andriopoulos, C. (2014). Managing Change, Creativity & Innovation (2) Sage Publications.

Dean, B. (2021) Social Network Usage & Growth Statistics: How many people use Social Media in 2021?. Available at: https://backlinko.com/social-media-users (accessed 04/04/2021)

Diebner, R. & Silliman, E. & Ungerman, K. Vancauwenberghe, M. (2020) Adapting customer experience in the time of coronavirus. Available at: https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/adapting-customer-experience-in-the-time-of-coronavirus# (accessed 01/05/2021)

Do, T. (2021) The Real Production Costs of Smartphones. Available at: https://www.techwalls.com/production-costs-of-smartphones/ (accessed 07/04/2021)

Emmer, M. (2019) Technological trends impacting business in 2020 and beyond. Available at: https://www.vistage.com/research-center/business-financials/economic-trends/121202-technological-trends-in-business-2020/ (accessed 04/04/2021)

Fox (2019) Google Hit with £44m DPR fine over ads. Available at: https://www.bbc.co.uk/news/technology-46944696#:~:text=Google%20has%20been%20fined%2050,valid%20consent%20regarding%20ads%20personalisation%22 (accessed 04/04/2021)

Gui, V. (2018) Increase Conversion with Personal Selling – How to do it online. Available at: https://prooffactor.com/blog/increase-conversion-with-personal-selling-how-to-do-it-online/ (accessed 06/04/2021)

Helme-Guizon, A and Magnoni, F (2019) ‘Consumer brand engagement and its social side on brand-hosted social media: how do they contribute to brand loyalty?’ Journal of Marketing Management, 35(7-8) pp.716-741. DOI: https://doi.org/10.1080/0267257X.2019.1599990

Hobbs, T. (2020) The biggest missed opportunity in digital advertising? Why brands need to get better at in-game advertising. Available at: https://www.thedrum.com/news/2020/11/09/the-biggest-missed-opportunity-digital-advertising-why-brands-need-get-better-game (accessed: 06/04/2021)

Holt, D (2020) ‘Cultural Innovation: The Secret to Building Breakthrough Business’, Harvard Business Review. Available at: file:///Users/admin/Downloads/Holt%20-%20HBR2020.pdf (accessed date: 04/04/2021)

Holt, D (2004) How Brands Become Icons: The Principles of Cultural Branding. Boston, Mass: Harvard Business School Press.

Huawei (2016) Lionel Messi Joins the HUAWEI Family of Global Brand Ambassadors. Available at: https://consumer.huawei.com/en/press/news/2016/hw-473993/#:~:text=Lionel%20Messi%20Joins%20the%20HUAWEI%20Family%20of%20Global%20Brand%20Ambassadors,-SHARE&text=%E2%80%9CLionel%20Messi%20will%20help%20our,where%20HUAWEI%20puts%20great%20devotions. (accessed 24/03/2021)

Huawei (2020) Huawei expands all-scenario product portfolio with six new products. Available at: https://consumer.huawei.com/en/press/news/2020/huawei-expands-all-scenario-product-portfolio-with-six-new-products/ (accessed 24/03/2021)

IbisWorld (2020) Mobile Telephone Retailers in the UK- Market Research Report. Available at: https://www.ibisworld.com/united-kingdom/market-research-reports/mobile-telephone-retailers-industry/ (accessed 04/04/2021)

IDC (2021) Smartphone Market Share. Available at: https://www.idc.com/promo/smartphone-market-share/vendor (accessed 04/04/2021)

Jersey Evening Post (2020) UK economy may not recover to pre-virus levels until 2024, says OBR. Available at: https://jerseyeveningpost.com/news/uk-news/2020/07/14/uk-economy-may-not-recover-to-pre-virus-levels-until-2024-says-obr/ (accessed 28/04/2021)

Kessous, A., Roux, E., & Chandon, J.-L. (2015) ‘Consumer-brand relationships: A contrast of nostalgic and non-nostalgic brands’. Psychology & Marketing, 32(2), pp. 187–202. Doi: https://doi.org/10.1002/mar.20772

King, B. (2021) Unemployment rate: How many people are out of work?. Available at: https://www.bbc.co.uk/news/business-52660591 (accessed 04/04/2021)

Kumar, A., Bezawada, R., Rishika, R., Janakiraman, R. and Kannan, P. K. (2016) ‘From social to sale: The effects of firm-generated content in social media on customer behaviour’, Journal of Marketing, 80 (1), pp. 7 – 25

Marvin, R. (2018) Fortnite by the Numbers: How Many Hours Are You Playing Each Week?, Available at: https://uk.pcmag.com/microsoft-xbox-one-2/117709/fortnite-by-the-numbers-how-many-hours-are-you-playing-each-week (accessed 06/04/2021)

McDonald, M. & Wilson, H. (1984) Marketing Plans: How to prepare them, How to profit from them. Available at: https://read.kortext.com/reader/epub/358556 (accessed 04/04/2021)

McGinnies, Elliott. and Charles D. Ward (1980) ‘Better liked than right: Trustworthiness and expertise as factors in credibility’, Personality and Social Psychology Bulletin, 6(3), 467- 472.

Mihaela, T. (2016) ‘Customer Relationship Management: A Theoretical Approach’, Economics Management and Financial Markets, 11(1), pp. 86-93.

Moise, D. & Cruceru, A.F. (2013) ‘Customer Relationships through Sales Forces and Marketing Events’, Procedia – Social and Behavioral Sciences, pp. 155 – 159, available at: https://core.ac.uk/download/pdf/81996575.pdf (accessed: 04/04/2021)

Morning Consult (2019) YouTubers are Among the Most Popular Celebrities for Gen Z. How Much Should Brands Prize Their Endorsements?. Available at: https://morningconsult.com/form/youtubers-are-among-the-most-influential-celebrities-for-gen-z/ (accessed 04/04/2021)

Moshfegh, L. (2020) Gen Z Millenials Prefer Apple Over Samsung. Available at: https://www.flurry.com/blog/gen-z-and-millennials-prefer-apple-over-samsung/#:~:text=Generation%20Z%20also%20shows%20a,21%25%20on%20a%20Samsung%20device (accessed 11/02/2021)

Muniz, A.M. & O’Guinn, T.C. (2001) ‘Brand Community’, Journal of Consumer Research, 27(4), pp. 412 – 432, accessed: https://doi.org/10.1086/319618

O’Dea, S. (2021) Smartphone unit shipments of Samsung worldwide by quarter from first quarter 2010 to fourth quarter 2020. Available at: https://www.statista.com/statistics/299144/samsung-smartphone-shipments-worldwide/

Overton, S (2019) Addicted and Overwhelmed: Why 1 in 3 UK Adults Are Cutting Back on Social Media. Available at: https://exposureninja.com/blog/cutting-back-social-media/ (accessed: 29/04/2021)

Roll, M. (2020) Identity Myths And Storytelling Are Keys To Building Iconic Brands. Available at: https://martinroll.com/resources/articles/branding/identity-myths-storytelling-keys-building-iconic-brands/ (accessed: 28/04/2021)

Samsung (2021) Samsung Research. Available at: https://research.samsung.com/whoweare (accessed 15/03/2021)

Samsung NewsRoom (2019) 10 for 10: Highlights from a Decade of Galaxy Innovation. Available at: https://news.samsung.com/global/10-for-10-highlights-from-a-decade-of-galaxy-innovation (accessed 25/2/2021)

Samsung NewsRoom U.S. (2018) Samsung Recognized for Green Power Leadership. Available at: https://news.samsung.com/us/samsung-recognized-green-power-leadership/ (accessed 25/03/2021)

Slefo, G.P. (2019) Fortnite emerges as a social media platform for Gen Z. Available at: https://adage.com/article/digital/fortnite-emerges-social-media-platform-gen-z/2176301 (accessed 04/04/2021)

Smartphones Revealed (no date) The most user-friendly smartphone. Available at: https://smartphonesrevealed.com/user-friendly-phones/ (accessed 25/03/2021)

Smith, J. (2020) Why in-game advertising now represents a powerful performance as well as a branding channel. Available at: https://www.thedrum.com/profile/the-digital-voice/news/why-in-game-advertising-now-represents-a-powerful-performance-as-well-as-a-branding-channel (accessed: 11/04/2021)

Sözer, E. & Vardar, N. (2009), ‘How does event sponsorship help in leveraging brand equity?’, Journal Of Sponsorship, 3(1), pp. 35-42.

Sweney, M., & Shoard, C., (2020) Apple does not ‘let bad guys use iPhones on screen’. Available at: https://www.theguardian.com/technology/2020/feb/26/apple-does-not-let-bad-guys-use-iphones-on-screen (acccessed 23/03/2021)

Stanley, L. (2019) Types of Modern Communication Devices. Available at: https://www.resourcetechniques.co.uk/news/technology/types-of-modern-communications-devices-102062 (accessed: 01/05/2021)

Talbot, A. (2020) 50% of Gen Z Consumers want Personalised Product. Available at: https://www.custom-gateway.co.uk/50-generation-z-consumers-want-personalised-products/ (accessed 06/04/2021)

Tanner, J.F. & Raymond, M.A. (2013) Principles of Marketing Version 2.0. California: Flat World Knowledge

Thomas-Bryant, K. (2021) How will Brexit Affect Businesses? 14 things you need to know. Available at: https://www.sage.com/en-gb/blog/how-will-brexit-affect-businesses/ (accessed 04/04/2021)