Financial planning is a process that includes retirement, tax, investment, insurance, and estate planning, along with financial management of how much you earn, spend, and borrow. A comprehensive financial plan should incorporate these six key areas, but what a financial plan looks like and how often you should update yours is a mystery to many Canadians.

A financial plan has no universally accepted format. The FP Canada Standards of Professional Responsibility for Certified Financial Planners (CFPs) acknowledges that “financial planning varies in scope and complexity, ranging from advice that is relatively straightforward and narrow to more complex engagements.”

Utah-based financial planner Carl Richards championed the concept of “the one-page financial plan” in his 2015 book of the same name. This simple approach has merit and has gained support in recent years, outlining things like cash flow, net worth, and financial goals on a single page.

Some wealth managers take a shock-and-awe approach to financial plans, involving subject matter experts like accountants and lawyers, culminating in a lengthy leather-bound presentation that delves deep into the different areas of financial planning.

Regardless, summarizing your personal financial situation and outlining your goals in writing can lead to accountability and action, while reducing financial anxiety.

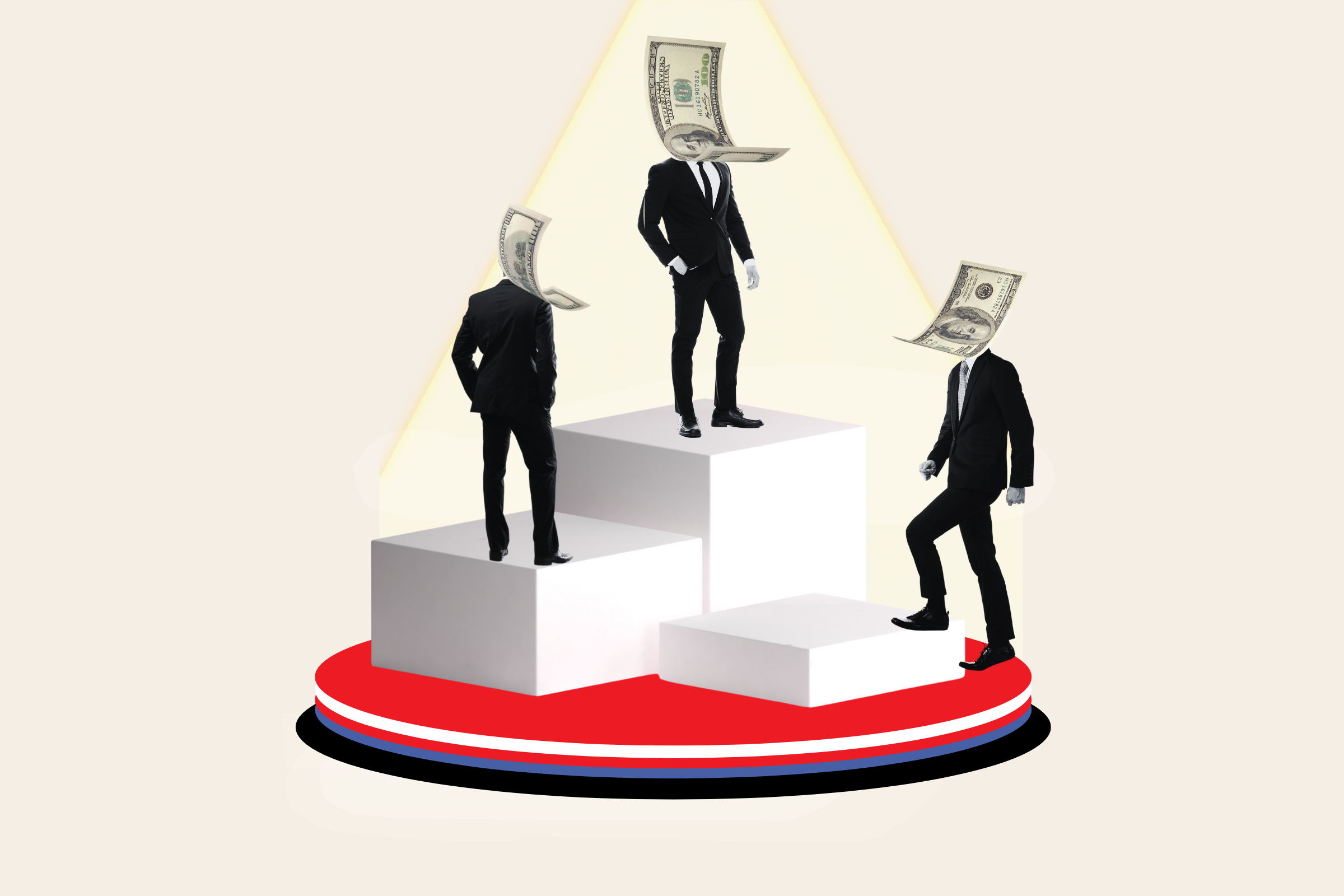

An inadequacy for many Canadians is that their financial adviser’s specialty may be investing, since this is how most people in the financial industry get paid. The selection of which securities to buy and sell is not a financial plan and should be a component of a bigger-picture approach to saving, spending, tax reduction, and estate preservation.

If an investor is high-net-worth (typically defined as having investable assets of at least $1 million), a financial plan may lead to a pitch to buy permanent life insurance to provide funds to pay tax upon death. If an investor forgoes paying these life insurance premiums, and keeps more of their money invested, they will also have more money to pay said tax on their death.

While life insurance has its place in risk management, as well as estate and tax planning, it bears mentioning that many financial planners at banks are bonused when their financial plans result in a life insurance sale – whether life insurance is the most suitable solution or not.

Despite the potentially unsuitable insurance sales focus among some, there are good financial planners who deliver good financial plans at the banks. Some independent wealth management firms provide financial planning as well, though most focus on investing. These financial plans are generally “free,” or at least paid for by the fees taken out of a client’s investments.

Accounting firms are starting to venture into financial planning, primarily for their most profitable business-owner clients. It makes sense. Accountants are incredibly busy the first half of the year doing taxes and have more time the second half of the year. They are also highly trusted professionals. Clients are used to paying them a fee for their services, and this increasingly includes financial planning. Often these plans are provided by related wealth management firms with the hope of landing a client’s investment assets.

There is a niche industry of professional financial planners called advice-only financial planners who focus solely on financial planning advice. The Canadian market has been slow to evolve, in part because an estimated 90 per cent of the financial services market is controlled by the Big Five banks. This means advice-only CFPs are rare and tend to have long wait lists.

A drawback is that regulation of these financial planners is loose in most provinces.

Their fees require an up-front payment, which may seem foreign to people used to getting financial advice at what seems like no cost, in exchange for an indirect payment from investment fees. And, unlike in the United States, advice-only financial planners here cannot provide recommendations about which investments to buy and sell, thus limiting their suite of services.

One problem with the way that financial plans have been used by the financial industry is that they tend to be transactional. In some cases, they may be primarily a prospecting tool to land a client’s assets and lead to the illusion of ongoing oversight. Financial planning should be a continuous exercise, rather than a pivot to a narrow focus on investing after developing an initial plan.

There are life events that should be a trigger, though. Buying a home, getting married, having kids, starting or selling a business, inheriting money, or planning to retire should be prompts to someone not already engaged in financial planning.

A recent survey from the Canada Pension Plan Investment Board found that 61 per cent of Canadians report being afraid of running out of money during their retirement. According to their 2024 Financial Literacy Month Retirement Survey, “Canadians with a financial plan are less concerned about outliving retirement savings. Among non-retirees, having a financial plan was the top reason they are not afraid of running out of retirement income.”

Family and financial situations evolve, tax rules and brackets change, and markets and interest rates fluctuate. As a result, a static financial plan completed yesterday is inferior to proactive planning done today with an eye toward tomorrow. Rather than a narrow focus on completing a financial plan, the noun “plan” should be replaced with the verb “planning” to avoid the misconception of finality.

Whether you are planning on your own or with a professional, there are ongoing considerations that should make your plan an ever-changing process. At the very least, once a year take time to update your version of a financial plan and think about your retirement, tax, investment, insurance, and estate matters.

Jason Heath is a fee-only, advice-only certified financial planner (CFP) at Objective Financial Partners Inc. in Toronto. He does not sell any financial products whatsoever. He can be reached at jheath@objectivecfp.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.