A panel of CEOs from registered investment advisors gathered at the WealthManagement.com Industry Awards in September to discuss key industry trends.

One key point was universally agreed upon: Organic growth is the industry’s North Star. As one CEO on the panel emphasized, “The single best measure of firm health is organic growth.”

But a secret that doesn’t get talked about much? Organic growth can be elusive.

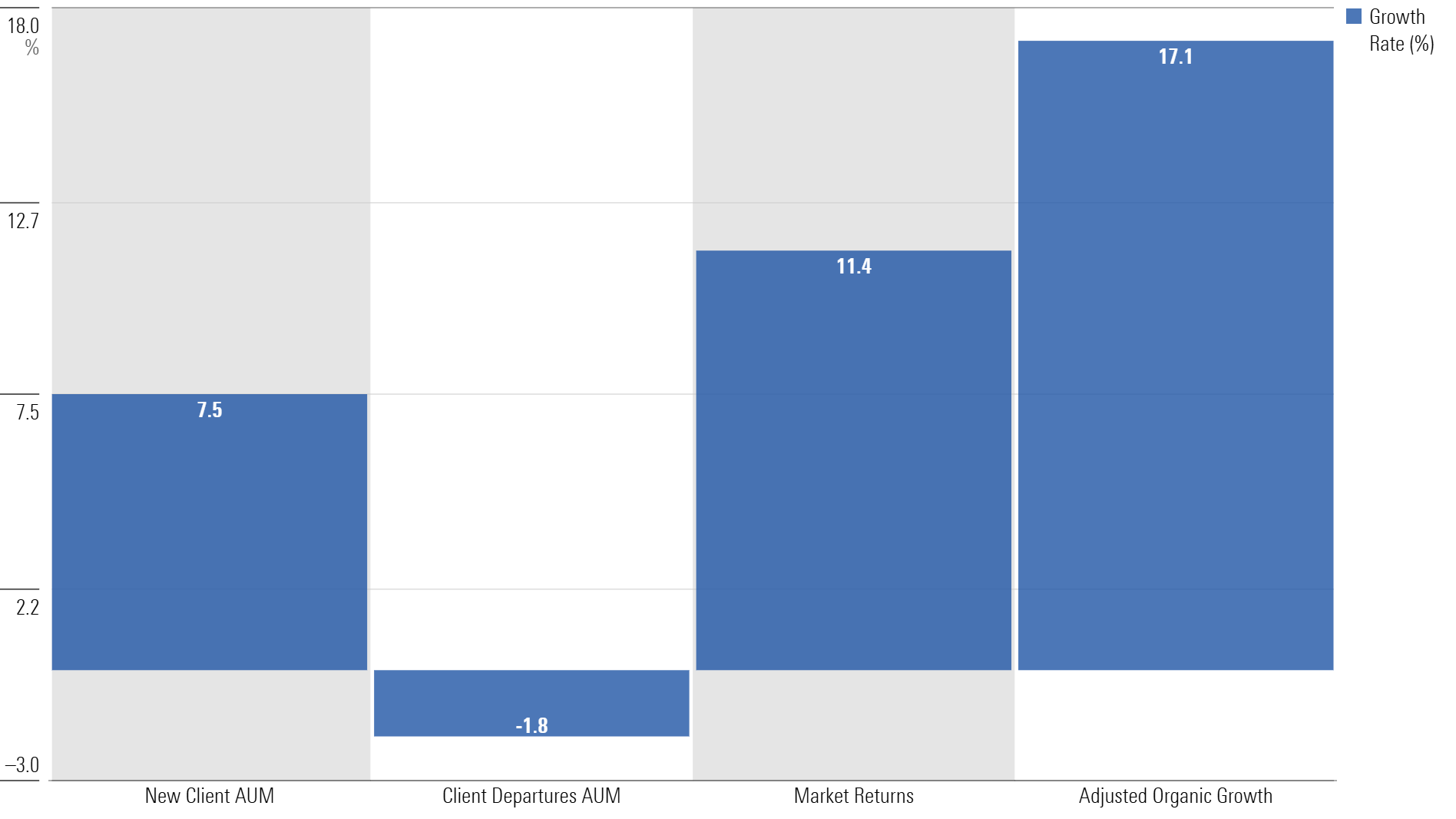

According to a recent study by The Ensemble Practice, the average RIA firm experienced organic growth of just 5.7% last year.

If we factor in market returns (2023 was a bull market, after all!) and consider them as organic growth, this number adjusts upward. The study estimated market returns contributed an additional 11.4% to growth; when factored in, this increases the average “organic growth” rate to 17%.

However, the reality of market returns is that they give and take. Last year’s returns are just that—last year’s returns—and cannot be reliably plugged into an RIA’s future growth algorithm.

Later in the month, Peter Mallouk, the CEO of Creative Planning, echoed similar sentiments about his firm’s growth at FutureProof, a conference for financial advisors. Mallouk referenced net client flows as the only statistic he focuses on, stating:

“One thing that I look at most, above all else, is flows. If our portfolios went up 50% next year and our assets under management went up $150 billion, but we had negative $1 billion in flows, it’d be worst year we ever had.”

Peter Mallouk

His point? Flows indicate whether you’re delivering something of value to the marketplace.

Creative Planning is one of the most successful RIAs, responsible for $300 billion in client assets. Since 2015, it has grown at 37% annually, marking nearly a decade of continuous “up and to the right.”

Of course, the caveat is that trying to learn lessons from one of the industry’s biggest firms can sometimes be self-defeating, as the insights may not apply to all advisors. But there are certainly bits of wisdom any advisor can steal from Creative Planning’s journey.

Foremost, organic growth appears to be the industry’s top priority. But where does it come from, and how can advisors build momentum behind it?

In most cases, it comes from referrals. The panel of CEOs estimated that referrals make up approximately 70% of the industry’s total client acquisition.

Data from Schwab supports this. As a disclaimer, there is no perfect dataset that captures everything happening among the thousands of RIAs across the country. However, Schwab’s analysis revealed that 60% of growth among what it classifies as “top-performing firms” came from referrals. From “all other firms,” that number is 71%.

Digging deeper, the next question is: How do you create a firm or culture that earns referrals?

Mallouk has previously discussed his experience, mentioning a significant part of it comes from existing clients referring new clients, stating, “Do [existing clients] like you enough to actually tell other people?”

Becoming a trusted financial partner to someone takes time and a consistent track record of delivering what you said you would. Relationships, much like investments, compound over time. And strong client relationships are the fuel that drives the financial advice business forward.

It sounds simple, but it’s not easy.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHBXSNJYDNAY7HDFQK47HGBDXY.png)