We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

The U.S. Department of Labor estimates you’ll need 70–90% of your pre-retirement income to maintain your standard of living in your golden years.

Citizens Financial Group reported that a range of $1 million to $1.5 million is needed to guarantee a comfortable retirement.

Don’t miss

Compare that to what many Americans have saved: a median of $185,000 for those aged 55-64, according to Federal Reserve data — a balance that may not be enough to last you.

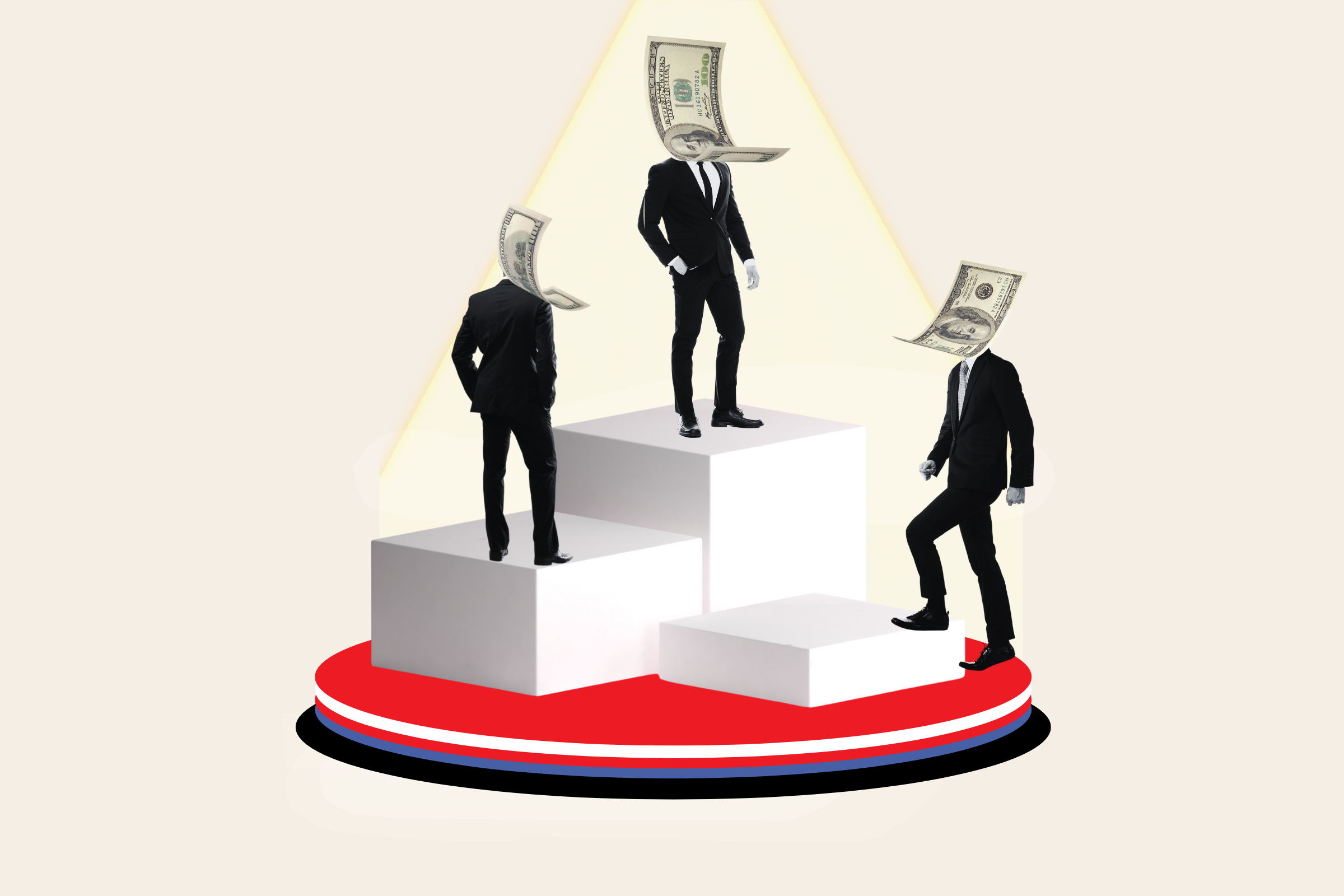

The wise strategy to grow your wealth is not to sit passively on your nest egg, but to continue building it.

Here are three strategies that the richest Americans use — and you can borrow — to help get your nest egg to the size you need for a comfy retirement.

Leverage tax-deferred growth

The IRS has no age limit on how long you can continue contributing to an individual retirement account (IRA) contributions, and your money will continue to grow tax-free as you save. But there are still contribution and deduction limits to be aware of.

If you’re covered by a retirement account at work, traditional IRA deductions are phased out for married couples if your modified adjusted gross income (MAGI) is between $123,000 and $143,000. With a Roth IRA, that phase-out happens between $230,000 and $240,000.

For single filers, the range is $87,000 to $161,000. Fortunately, the IRA contribution limit in 2024 is $8,000 if you’re 50 or older, up more than 14% from 2022.

While Roth IRAs are a key savings vehicle, you’ll also want assets that protect you from inflation and stock market volatility.

A gold IRA, for example, allows you to hold physical assets like gold, providing a hedge against both inflation and the ups and downs of the market. Although it will be subject to income tax, and will contribute to your taxable income upon retirement, a gold IRA can be a terrific risk-adjusted complement to a Roth IRA, which could be riskier depending on assets you hold inside.

Thor Metals is an industry leader in precious metals and an authorized dealer for the U.S. Mint. The company can help you seamlessly manage the complexities of setting up and managing your gold IRA.

Get a free 2024 Wealth Protection Guide to help you determine if this investment is right for you and your retirement.

When you’re feeling unsure about how to set up your retirement accounts, and how to meet a seven-figure savings goal, it’s time to call in a pro.

Professional advisors — like those at Advisor.com — can help you create a money management plan. Whether you’re looking to diversify your portfolio or grow your nest egg, Advisor.com connects you with experienced financial advisors who can help you reach your financial goals.

By partnering with a reputable advisor, you’ll gain expert insights into which alternative assets align best with your goals. Once you’re matched, you can schedule a free consultation to discuss your financial strategy and explore the investment options available to best suit your needs.

Read more: I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 3 of the easiest ways you can catch up (and fast)

Move to a less expensive part of the country

From 2015 to 2019, only 5.9% of people aged 65 to 74 chose to relocate, according to U.S. census data. But definite financial advantages lie in moving from a high-cost-of-living locale to a much less expensive one. As of the second quarter of 2024, the Council for Community and Economic Research found that the Cost of Living Index in San Francisco (the nation’s fourth-most expensive city) is 167.4.

Meanwhile, Amarillo, Texas, one of the cheapest cities to live in, has a score of 83.1. If you want to stay closer to your hometown, a cost-cutting move is also entirely possible. RentCafe estimates that the cost of living in Rockford, Illinois is significantly lower than in Chicago — only 90 miles away.

Whether you stay or you go, one beneficial way to lower costs for your home is to shop around for a better deal on your home insurance.

BestMoney is an easy-to-use platform that can help you compare home insurance rates in your area.

Shopping for a better policy is fast and easy: All you have to do is answer a few quick questions about yourself and your home, and you’ll see get a list of quotes tailored for your needs.

A report by MarketWatch also found that Americans struggle to keep the monthly cost of car ownership below the recommended threshold of 10% of their monthly income. On average, we’re spending 20%. Lowering this expense can give you more funds to add to your retirement savings.

When you use OfficialCarInsurance, you can ensure that you’re cutting your insurance costs down to size.

Getting started with a quote is easy: When you enter your age, your home state, the type of vehicle you drive, and your driving record, OfficialCarInsurance will sort through the leading insurance companies in your area, including top providers like Progressive, Allstate and GEICO. You can then easily compare rates and choose the policy that best suits your needs and budget.

Invest a small portion of your portfolio in cryptocurrency

Yes, cryptocurrency has a well-earned reputation for volatility. But many financial experts say it is potentially profitable to invest in it, as long as you limit your risk exposure.

Working with retirees worth between $2 million and $10 million, certified financial planner Evan T. Beach told Kiplinger that crypto should typically make up no more than 5% of your portfolio. “Rich Dad, Poor Dad” author Robert Kiyosaki also has optimistic predictions for Bitcoin in particular.

When the virtual currency was testing $30,000 in October, Kiyosaki predicted, “Next stop Bitcoin $135,000.” If his predictions were to come true, it would result in an incredible lift of 277%.

For those interested in the world of digital currencies, Coinbase is the largest crypto exchange in the U.S. With over $269 billion in safeguarded assets and 245,000 partners in 100 countries, Coinbase is a trusted name in the crypto space.

It offers a secure platform for buying, selling, and storing digital currencies like Bitcoin, Ethereum, and Litecoin. And with its own wallet service, you can store hundreds of different cryptocurrencies securely on the platform.

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.