More Americans are turning 65 this year than at any other time in history.

That record is expected to be broken again next year. Roughly 4 million people will be turning 65-plus every year through the end of this decade.

Why does that matter?

Well, the age of 65 is a common mile marker that represents retirement. Of course, people are living and working longer these days, so it’s not necessarily true that these numbers represent precise figures that will be leaving the labor force. But the broader demographic trends are clear: Large waves of people will be retiring through the end of this decade.

That’s great news for financial advisors.

Why? Because large cohorts of people will need good financial advice, specifically around financial planning. According to Ron Carson—founder of Carson Group, one of the largest registered investment advisors in the country—only 23% of people preparing for retirement have a written plan.

Now, not every investor will need or want a written plan. Many do-it-yourself investors will be fine without one—the number will never be 100%.

But it’s likely a safe assumption that the number of individuals seeking comprehensive financial planning will increase over the next decade. Many advisors will be hard at work guiding retirees through various facets of planning across retirement, tax, estate, and other specialized planning areas.

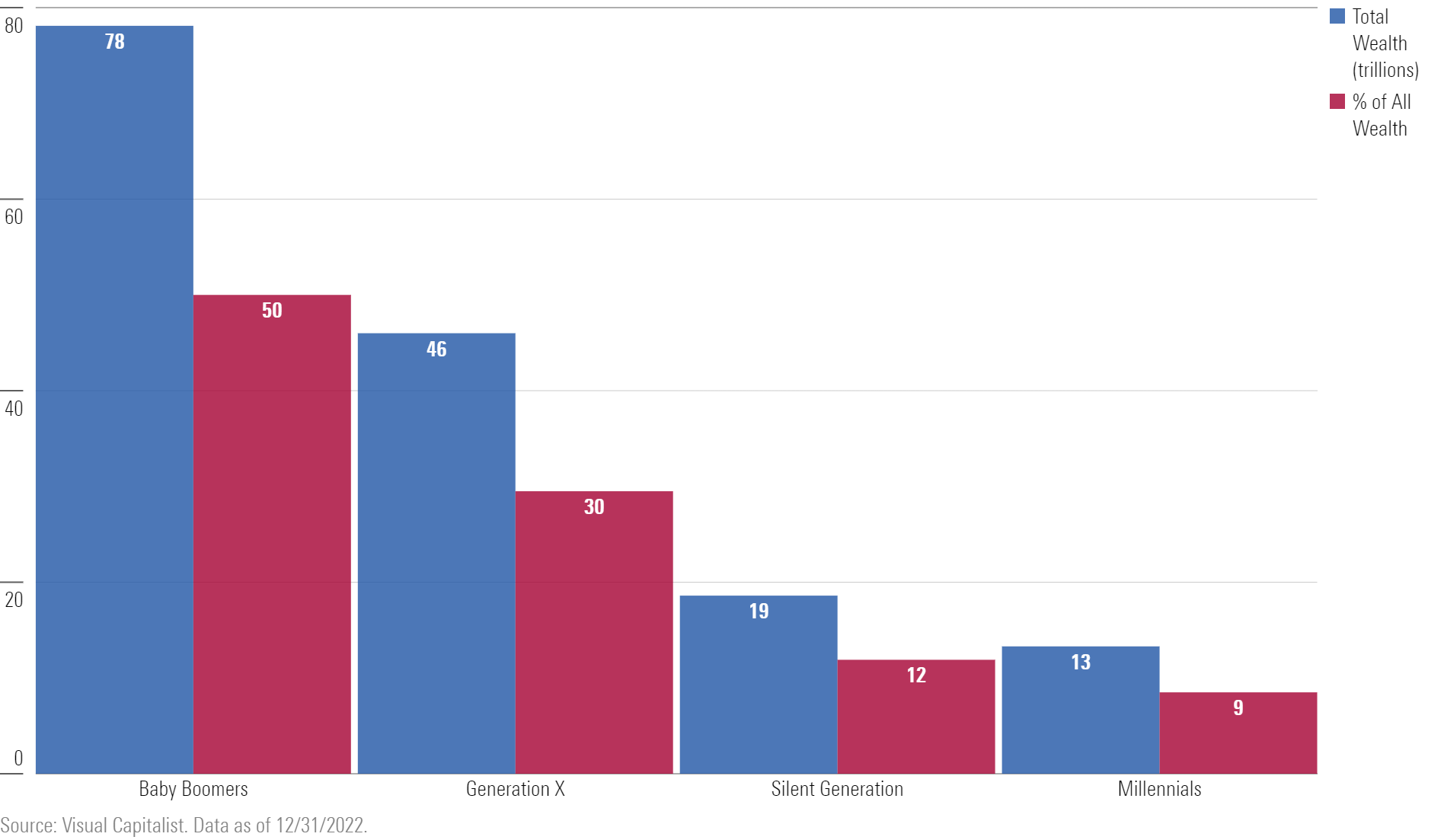

And it’s not just the baby boomer generation that will need advice. Obviously, this generation controls most of the wealth—estimated at nearly $80 trillion, which represents half of all wealth in this country.

But that money will eventually be passed down, leading to the belief that the next decade could be the greatest wealth transfer in history. A study from Knight Frank details that over $90 trillion in assets will move between generations over the next 20 years. This process will likely change the narrative for millennials from one that is heavily indebted to one that is incredibly wealthy.

As the Knight Frank study mentioned, this multidecade shift will make “affluent millennials the richest generation in history.” So, the generation most often associated with debt—primarily from student loans—is expected to make the transition to the wealthiest generation over the next decade-plus.

Financial advisors will have a pivotal role to play managing the impact of this demographic earthquake:

- How do advisors best serve clients across generations?

- How do client goals and priorities differ across the age spectrum?

- What are the main factors that advisors must consider to deliver the best client experience to each generation?

All this and more was discussed on a recent podcast episode of Simple but Not Easy, which can be accessed here.

If you enjoy this content, please consider subscribing to the podcast on Apple or Spotify so you never miss an episode!

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

The author or authors do not own shares in any securities mentioned in this article.

Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UWZH3VLHBVCIDP2ANJ73YKE4QA.png)