LPL Financial Holdings Inc. LPLA announced the completion of the Crown Capital Securities, L.P. acquisition. The deal, announced in July 2023, expands the company’s footprint in the California market and solidifies its wealth management business.

Crown Capital is a full-service broker-dealer and registered investment advisor based in Orange County, CA. Founded in 1999, it provides services that include investment management, estate planning, risk management, education planning, corporate benefits, full-service brokerage and alternative investments.

As of May 8, 2024, roughly $1.3 billion of brokerage and advisory assets served by roughly 125 advisors have been onboarded to LPLA. The remaining roughly $3.7 billion of the assets are expected to be onboarded over the next several months.

LPLA’s industry-leading platform is expected to provide Crown Capital advisors with enhanced operational support, streamlined processes and access to cutting-edge technology and integrated advisor tools. While Crown Capital advisors will enjoy the benefits of LPL Financial’s robust infrastructure, they will maintain their independence, continuing to serve the clients with the same dedication and commitment they have exhibited throughout the years.

Rich Steinmeier, managing director and divisional president of business strategy and growth of LPL Financial, said, “Through LPL’s advisor-first focus and by leveraging our innovative platform and specialized services, the high-performing advisors at Crown Capital Securities are even better positioned to scale their thriving businesses.”

The acquisition signifies a strategic move for LPLA, reinforcing its position as a leading wealth management service provider. Over the years, the company has accomplished several strategic buyouts that have helped diversify revenues and bolster growth.

Further, this February, LPL Financial announced a deal to acquire Atria Wealth Solutions, Inc. This move underscores the company’s commitment to expanding its reach and enhancing its offerings in the wealth management solutions market. Moreover, in December 2023, LPLA took a minority stake in Independent Advisor Alliance, which aligns with its ongoing approach of trying to collaborate with as many advisors as possible under any circumstance.

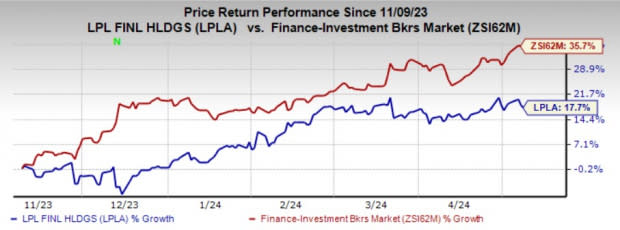

Over the past six months, shares of LPLA have rallied 17.7% compared with the industry’s 35.7% growth.

Image Source: Zacks Investment Research

Currently, LPL Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Expansion Efforts by Other Financial Services Firms

Earlier this month, BlackRock Inc. BLK closed the acquisition of SpiderRock Advisors, LLC. This strengthened the company’s capabilities to provide a robust platform to its clients with customized separately managed accounts (SMAs) solutions.

The deal is expected to enable BLK’s SMA solutions to meet the increased demand for personalized, tax-efficient portfolios by wealth managers. The financial impact of the acquisition will be immaterial to 2024 earnings.

Similarly, last month, UMB Financial Corp. UMBF signed a definitive agreement to acquire Heartland Financial, USA Inc. HTLF in an all-stock transaction valued at around $2 billion.

The deal is expected to further diversify UMBF’s business, adding scale to its consumer and small business capabilities and expanding its footprint in the Midwest and Southwest markets. HTLF had $19.4 billion in assets, $16.2 billion in total deposits and $12.1 billion in total loans as of Mar 31, 2024.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

UMB Financial Corporation (UMBF) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

Heartland Financial USA, Inc. (HTLF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research